Keystone XL: The Art of NGO Discourse | Part I

April 12, 2013

Part one of an investigative report by Cory Morningstar

Keystone XL Investigative Report Series [Further Reading]: Part I • Part II • Part III • Part IV

Tar Sands Action & the Paralysis of a Movement – Investigative Report Series [Further Reading, September, 2011]: Part I • Part II [Obedience – A New Requirement for the “Revolution”] • Part III [ Unravelling the Deception of a False Movement]

Gloat Like Rockefeller When Watching Trains

On Nov 3, 2009, Berkshire Hathaway, the investment vehicle of Warren Buffett, announced its plan to purchase the 77.4 percent of Burlington Northern Santa Fe (BNSF) that it did not already own for $26 billion in cash and stock – the largest deal in Berkshire history. The deal, which included Berkshire’s prior investment and the assumption of $10 billion in Burlington Northern debt, brought the total value to $44 billion. Buffett remarked it was a big bet on the United States.“Buffett Says Gloat Like Rockefeller When Watching Train” – March 5, 2013

It was TO be a bet that both President Barack Obama and Secretary of State, Hillary Clinton, would ensure he DID not lose.

“There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

– Warren Buffett

Fait Accompli

Fait accompli: “An accomplished fact; an action which is completed before those affected by it are in a position to query or reverse it.”

Barack Obama owes much gratitude to 350.org et al. Under this administration, grotesque atrocities and ecological devastation are accelerating around the world at an unparalleled speed – all in the name of the American people. Despite this fact, 350.org, Sierra Club, Natural Resources Defence Council, Greenpeace and friends all excel “beyond the call of duty” in painting this same regime in the clean, shiny patriotic colours of red, white and blue; glossed over in an emerald green vellum, drenched in the hope industry’s PR slogans and feel-good symbolic campaigns. In reality, 350.org and other Obama sycophants could not care less about stopping the tar sands. Hence, they wittingly draw your attention to a pipeline the industry doesn’t need.

The Show’s Over

… “[T]here are about 18 billion dollars worth of other pipeline projects that [are] totally approved, ready to go, nothing standing in their way, shovels essentially in the ground and these all will be ready by about 2015….” Nov. 8, 2012 Globe & Mail video, Canada’s pipelines: Beyond Gateway and Keystone

The proposed KXL pipeline through Montana, South Dakota and Nebraska has seemingly provoked strong opposition from environmental NGOs and activists who argue that extraction of crude oil from tar sands increases greenhouse gas emissions that cause global warming. The second highlighted point of contention is the safety of the pipelines, which are prone to spills and leaks. Yet this is a strategic public relations campaign on the part of 350.org et al: brilliantly executed misinformation by design. In the case of KXL, a design whereby the NGO frames the main objections (in this case pipeline safety) while industry quietly implements a “solution” that will be somewhat condoned by the public. Case in point: Tar sands oil pipelines (and all other pipelines) leak. They are difficult to maintain and require ongoing maintenance. Contamination of fresh water, soil and sensitive ecosystems is a very real threat and concern. The main selling feature of the rail tanker put forward by industry as a solution is that they are nearly impervious to puncture and leaks, having been designed to bounce if a trains derails. In response, the NGOS within the complex will issue little to no rebuttal, effectively signaling to the public that rail must be a safer option.

“Anthony Swift, an attorney for the Natural Resources Defense Council and co-author of one of the critical pipeline safety reports, said railroads don’t offer a feasible alternative to pipelines from Canada. He said tar sands producers aim to triple oil output by 2030, which would outstrip railroads’ capacity. But the U.S. State Department, in a report on Keystone XL issued Friday, said ‘the proven ability of rail to transport substantial quantities of crude oil profitably’ means that denial of the project ‘is unlikely to have a substantial impact on the rate of development in the oil sands, or on the amount of heavy crude oil refined in the Gulf Coast area.’

“As anti-pipeline groups have pressed the White House to kill the project, the oil and railroad industries have been building oil-loading terminals and buying tank cars to ship Canadian crude oil by rail. ‘There is no permitting required — you can put oil on rail and nobody can complain,’ said Sandy Fielden of RBN Energy, a Houston-based consulting firm that has tracked the oil-by-rail boom. In the campaign against Keystone XL, the National Wildlife Federation and other groups have issued two reports since 2011 critical of pipeline safety, singling out Canada’s heavy oil called bitumen as especially hazardous. Neither report mentioned the risks of shipping it by rail. Yet the dramatic growth of the crude-by-rail business in North America illustrates how quickly shippers can adapt to a new option. North Dakota, the nation’s No. 2 oil-producing state behind Texas, ships the majority of its oil by rail from loading terminals built mostly in the past three years.” — March 3, 2013, Canadian crude oil finds a new pathway through Minnesota [Emphasis added]

Very few in the environmental movement wish to discuss, let alone acknowledge, the very ugly reality that the “Stop the KXL!” campaign has absolutely nothing to do with shutting down tar sands production. The actuality is that behind the protest signs (that conveniently blur lines and bear much semblance to the Obama branding campaign), we have an entire rail transport industry burgeoning to transport the oil formerly designated for the KXL pipeline.

The show is over. It matters little whether Keystone is approved or not. If it is approved, we have a flourishing rail economy plus the KXL pipeline. Bread and circuses have never been so skillfully orchestrated. Immense quantities of the Canadian oil that the KXL pipeline is designed to carry will still roll into the United States – on railroads with tracks through Minnesota. If the KXL is denied, Obama gains symbolic credibility and legitimacy under the guise of “green” leadership, which automatically extends to 350.org and friends. This would build much trustworthiness for both Obama and for future campaigns to advance the illusory green economy. One must also consider, as Forbes pointed out on January 19, 2012, that even TransCanada shareholders will not lose: Goldman Sachs (GS) estimates that if TransCanada, which has already invested $1.9 billion in the project according to Business News Network, canceled the project, its earnings per share in 2012 and 2013 would rise between 5% and 10% due to a reduction in TransCanada’s capital expenditures and financial costs.

With the “light sweet oil” (note the terminology/framing of the US oil in the media, which is in stark contrast to Canada’s “heavy sour crude” (bitumen), singled out as especially hazardous in two reports issued by the NGOs since 2011) now flowing from Texas and North Dakota, perhaps Obama can afford to nix the KXL in exchange for adoration from the non-profit industrial complex who would shower him with (more) undeserved praise. Yet, because the non-profit industrial complex is no doubt considered nothing more than useful idiots by the oligarchs, and because quarterly profits bear more credence than does credibility among a small percentage of the populace that the oligarchs care nothing about, it is more than likely the pipeline will be approved by the corporatocracy. After all, America’s thirst for continued rabid consumption is insatiable – a thirst that can only be quenched by oil.

Either way, Obama unequivocally demonstrated his immense loyalty to Warren Buffett. Buffett has revitalized rail – an industry thought to be essentially dead. The delay of the pipeline was all he needed. His investments are secure. The pipeline will not interfere with the firm foothold this revitalized industry has achieved. Few notice. The non-profit industrial complex is silent.

Another Hard Lesson for Humanity

The March 25, 2013 Market Watch slideshow 21 stocks to play the crude-by-rail trend makes clear what transpired over the last 3 years while progressive media and progressive greens ensured that your attention stay focused on the KXL campaign.

Jan 14, 2013, North American energy companies are starting to invest more in railroad terminals than the railroads themselves:

“A group of oil and gas pipeline operators led by Plains All American Pipeline LP (PAA) announced plans just in the past three months to spend about $1 billion on rail depot projects to help move more crude from inland fields to refineries on the coasts. Warren Buffett’s Burlington Northern Santa Fe LLC, the largest U.S. railroad, spent $400 million on terminals in 2012…. Producers and refiners such as Devon Energy Corp. (DVN) and Irving Oil Corp. say they’ll turn even more to rail to get domestically pumped crude to the highest-paying refineries…. More than 200,000 train cars of oil will be shipped in 2012, the most since World War II, according to forecasts from the American Association of Railroads. About 1 million barrels a day of rail-unloading capacity is being built in the U.S., Olsen wrote in a note. That’s more than double the current level of shipments, which averaged about 456,000 barrels a day in the third quarter, according to the Railroad Association.”

Of course, all new railroads will also lead to new refineries and new tank cars. On Feb 4, 2013, it was reported that Phillips 66 and Valero Corp. plan to purchase 2,000 and 1,000 rail cars, respectively. Phillips 66’s rail efforts will focus on moving Bakken crude while Valero will utilize rail to move oil sands away from Alberta. [1] Such corporate entities will require the use of Buffett’s Berkshire Hathaway (Burlington Northern’s) rail lines to achieve their stated goals. Berkshire’s latest quarterly earnings show that the largest revenue growth for the railroad company has come from increased petroleum shipments. Union Tank Car Co. is already working at full capacity to produce rolling containers that carry the fuel in trains. Union Tank Car Co. is owned by Marmon group. In 2007, 60% of Marmon Holdings was acquired by Buffett’s Berkshire Hathaway, with the remaining 40% to be acquired in the next five to seven years. Note that on July 13, 2012, Buffett announced it had invested in shares of Phillips 66 (27 million shares). Shares of Phillips 66 (which was spun-off from Conoco) have already surged more than 83% since May 2012 when the deal was completed. [Jan 29, 2013] Phillips 66 recently finalized a five-year agreement with Global Partners LP to ship 50,000 barrels a day of Bakken crude to its New Jersey refinery by train in a deal worth an estimated $1 billion.

March 2013: Sens. Lautenberg and Rockefeller Introduce Transportation Investment Bill

March 01, 2013, ProgressiveRailroading.com:

“‘Investing in our nation’s roads, rails, and runways will get people back to work, while spurring economic development and productivity,’ said Lautenberg, who chairs the Senate’s Commerce Subcommittee on Surface Transportation and Merchant Marine Infrastructure, Safety and Security. ‘This bill would establish a creative new way to leverage federal funding and increase investment in projects that will expand rail capacity.’ All options ‘need to be on the table’ to rebuild and expand rail systems, ports, highways and airports, said Rockefeller, who chairs the Senate Commerce Committee.”

Obama and Buffett – The Love Affair Continues

Image: Awarded: President Obama has been very open with his admiration for Warren Buffett, bestowing on him the highest civilian honor in America in 2011

On April 18, 2012 the Daily Mail, UK published an article titled “The love affair continues: Warren Buffett’s Time 100 tribute is written by… Barack Obama.” The article states “The close personal relationship between President Barack Obama and financier Warren Buffett is no secret. Though he already awarded Mr. Buffett with a Presidential Medal of Freedom, which is the highest civilian honour in the country, and a tax policy bearing his name, Mr. Obama went a step further and personally wrote an ode to the 81-year-old investment advisor in Time Magazine’s top 100. The list of the world’s most influential newsmakers, Mr. Obama wrote a three paragraph dedication extolling Mr Buffett’s moral values in addition to his economic prowess [sic].”

2007-2008 | Buffett, Gates and Obama

“Buffett, who has made substantial resource investments this decade, after a history of avoiding them, is now interested in the Alberta oil sands. His rationale is that it is a known resource, says Hull, who manages money for clients of Berkshire Securities Inc., recently acquired by Manulife Financial Corp. In contrast to speculative drilling, oil-sands projects are mining operations where the size of the reserves is known. One can calculate with relative certainty the breakeven requirements over 10 years. And production costs tend to drop as the extraction and processing technology improves. Buffett Predicts a Long Flight for Loonie, Toronto Star, Oct 13, 2007

On May 3, 2012 research fellow Steve Horn writes:

Consider this: One month after jointly visiting Arch Coal’s mammoth Black Thunder strip mine in Wyoming with a fleet of nine private jets, billionaires Bill Gates and Warren Buffett sat in President Obama’s Oval Office on December 14th and discussed ways to improve the economy. As the CEO of Berkshire Hathaway, Buffett understands the economics of coal better than anyone: He owns the Burlington Northern Santa Fe Railroad that transports most of Wyoming’s vast coal supply around the country, along with the utility company, MidAmerican Energy, which operates 11 coal-fired power plants, including four in Wyoming. The Buffett/Gates trip took place roughly one year after another key Buffett/Gates visit to the Alberta Tar Sands in August 2008, in which the two of them, according to an unidentified source, “took in the oilsands, apparently with awe.”

2010: Billionaire Warren Buffett Acquires Full Control of BNSF Rail

“Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.” — Warren Buffett, The New York Times, October 2008

On April 24, 2011, the Canadian Globe and Mail writes: “Through holding company Berkshire Hathaway Inc., billionaire Warren Buffett acquired full control of Burlington Northern Santa Fe Corp. of Fort Worth, Tex., in early 2010. Berkshire already owned 22.6 per cent of BNSF before it took complete ownership. Mr. Gates and Mr. Buffett ‘are pretty good buddies. Mr. Buffett must have given a tip to buy railroads at one of their bridge games,’ Mr. Spracklin said with a laugh.”

Buffett’s Berkshire Hathaway (NYSE: BRK-B) began to acquire Burlington Northern Santa Fe railroad stock in 2007.

With a net worth fluctuating around the $53.5 billion mark (2013), Warren Buffett has been an influential and prominent political backer of Barack Obama since the 2008 US presidential campaign. [2] During the second 2008 U.S. presidential debate, candidates John McCain and Barack Obama both made mention of Buffett as a possible future Secretary of the Treasury. In the third/final presidential debate, Obama made reference to Buffett as a potential economic advisor. Buffett was cited the wealthiest person on the planet in 2008, and third wealthiest in 2011, a position that he often exchanges with friend Bill Gates. In 2012, corporate media (Time) cited Buffett as one of the most influential people in the world. Foreign Policy cited Buffett, along with Gates, as the most influential global thinkers in their 2010 report. Framed as the ultimate darlings of philanthropy by corporate media, the charismatic Buffett leads the diversion, donating billions of his monetary wealth to the Bill and Melinda Gates Foundation. [3] In June 2006, Buffett announced he would join the board of directors of the Gates Foundation.

There is little doubt that Buffett is brilliant, albeit tragically short-sighted. Buffett’s modest lifestyle (in relation to his wealth) demonstrates unequivocally that it is not the love, nor need, of money that inspires one to pursue such wealth – rather, it is the addiction to power.

Influential Networking Tycoons

Clintons, Warren Buffett, 1Sky/350.org, Berkshire Hathaway

“Philanthropy, we are told, is to replace the welfare state: instead of attempting to redistribute wealth via taxation and democratic planning, austerity politicians are in the process of dispatching with what they view as an irritating relic of working class history. In its place we are informed that we should rely upon the charity of the greediest and most exploitative subset of society, our country’s leading capitalists. A group of individuals whose psychological temperament is better described as psychopathic rather than altruistic.” — Michael Barker citing Joel Bakan, The Corporation: The Pathological Pursuit of Profit and Power, Free Press, 2004

Warren Buffett is an avid admirer of Hillary Clinton and has endorsed her for the 2016 US Presidential campaign. Buffett’s admiration and support for Clinton (financial and otherwise) is much warranted. The delay of the KXL has meant billions of profit in Buffett’s investment in the booming rail industry.

Buffett began to “purchase” Obama and Clinton as far back as 2007. One can safely say he “owns” them both outright today. It matters little. A man of such monetary wealth such as Buffett has the capacity to bring down the entire US economy if he were to fail. One can be certain of one thing: there is absolutely nothing Obama or Clinton would not do for Warren Buffett.

On June 18, 2007 Bloomberg reported that “[T]he blind trust of New York Senator Hillary Clinton and former President Bill Clinton invested in such companies as Rupert Murdoch’s News Corp., Wal-Mart Stores Inc. and Warren Buffett‘s Berkshire Hathaway Inc…” Clinton had dissolved the trust earlier in the month due to the visible conflicts of interest this would pose in light of her democratic presidential nomination. The Clintons “owned between $15,000 and $50,000 in Buffett’s Berkshire Hathaway.” The trust represented $5-$25 million of the Clintons’ overall assets which were valued between $11 million and $51 million. On February 1, 2013 ABC News reported that Bill Clinton was #2 in “The 50 Most Influential Networking Tycoons” by Wealth-X who “estimates his net worth at around $38 million. However, the value of his circle of influence is $227 billion.”

What the environmental “movement” does not wish to acknowledge is the fact that the Clintons were integral to the creation of 1Sky (1Sky/350.org) as were the Rockefellers. In the Rockefeller Family Fund 2007 annual report, it is clear that 1Sky is an actual Rockefeller-initiated NGO. Such incubator projects are common within powerful foundations, although the public has little knowledge of such practices. An example of a Rockefeller incubator for an in-house project that later evolved into a free-standing institution is The Climate Group, launched in London in 2004.

“The Clinton Global Initiative and Power Shift 2007 helped put us on the map, and EchoDitto donated time to help launch our interactive website…. Indeed, the growth trajectory of this campaign has been breathtaking.” — 1 Sky’s (350.org) first Annual Report: 2007-2008

For anyone familiar with the Rockefellers’ elitist, racist, classist and anti-democratic history, or the ideological framing and expansion of neoliberalism under the Clinton administration, this in and of itself should sound off alarm bells as to the political incentives guiding the financial support (i.e., investment) that launched 1Skys/350.org’s existence.

In April of 2011, 1Sky and 350.org announced their “official” merger, even though they were already intertwined from the outset [The Climate Cartel: 1Sky, 350.org and Rockefeller Brothers | Stronger as One, July 9, 2011]. 1Sky Education Fund was the legal entity of 350.org [Page 35 of the 2011 350.org 990 filing: “April 5 – Amending the articles of incorporation and bylaws to change the name of the corporation from 1Sky Education Fund to 350.org]. An obvious question would be why the Clintons would help create, partner with (via the Clinton Global Initiative), endorse and heavily promote an NGO that would, within 3 years (Feb 4, 2010), come to oppose the Keystone XL under the watch of then secretary of state, Hillary Clinton.

“While many corporate executives may well have numerous commendable personal traits, their commitment to pursuing their own class interests — at the expense of the mass of humanity — necessarily means that they must master the means to mask their illegitimate power and actively encourage a sense of futility amongst the governed. The creation of non-profit corporations, otherwise known as philanthropic foundations, thereby serves a critical function for powerful elites: letting them distance themselves from their psychopathic for-profit offspring, and allowing capitalists to recast themselves as good Samaritans striving to work for the common good.” — Michael Barker, Oct 31, 2012, Return to Philanthropy?

“Through their donations and work for voluntary organizations, the charitable rich exert enormous influence in society. As philanthropists, they acquire status within and outside of their class. Although private wealth is the basis of the hegemony of this group, philanthropy is essential to the maintenance and perpetuation of the upper class in the United States. In this sense, nonprofit activities are the nexus of a modern power elite.” —Teresa Odendahl, 1990, Bill Clinton’s Philanthropic Propaganda

Former president Bill Clinton announced the 1Sky campaign in September of 2007 at the Clinton Global Initiative. Rockefeller Brothers Fund President Stephen Heintz; Betsy Taylor, 1Sky Chair; and Jesse Fink, Mission Point Capital Partners, joined President Clinton on stage in recognition of the Rockefeller Brothers Fund commitment to 1Sky. The Rockefeller family contributed at minimum $1-$5 million to the Clinton Foundation. [Rockefellers’ 1Sky Unveils the New 350.org | More $ – More Delusion, April 18, 2011]. Bill Clinton is cited as an ally on the 1Sky/350.org website under “notable people.”

Video: 1Sky at Clinton Global Initiative (running time: 4:14)

https://youtu.be/_3PVGLseoGE

Like his friendship with both Obama and Gates, Buffett holds a strong relationship with extensive corporate ties to the Clintons. In June 2011, Nation reporters visited the “hurricane-proof” shelters in Haiti, contracted by Clinton’s foundation:

“June, six to eight months after they’d been installed, we found them to consist of twenty imported prefab trailers beset by a host of problems, from mold to sweltering heat to shoddy construction. Most disturbing, they were manufactured by the same company, Clayton Homes, that is being sued in the United States for providing the Federal Emergency Management Agency (FEMA) with formaldehyde-laced trailers in the wake of Hurricane Katrina. Air samples collected from twelve Haiti trailers detected worrying levels of this carcinogen in one…. Clayton Homes is owned by Berkshire Hathaway, the holding company run by Warren Buffett, one of the private-sector members of the Clinton Global Initiative, according to the initiative’s website. (“Members” are typically required to pay $20,000 a year to the charity, but foundation officials would not disclose whether Buffett had made such a donation.) Buffett was also a prominent Hillary Clinton supporter during the 2008 presidential race, and he co-hosted a fundraiser that brought in at least $1 million for her campaign. By mid-June, two of the four schools where the Clinton Foundation classrooms were installed had prematurely ended classes for the summer because the temperature in the trailers frequently exceeded 100 degrees, and one had yet to open for lack of water and sanitation facilities.” [Emphasis added]

On December 19, 2008, the Wall Street Journal reported that the Bill & Melinda Gates Foundation gave $22.5 million to Bill Clinton’s foundation. By April 2011, during the focus on the Stop the Keystone XL! campaign, Gates had become the largest shareholder of Canadian National (CN) rail.

Professional greens with ties to 350.org/1Sky are privy to secret meetings at the White House, something that has been documented in mainstream press. As an example, on November 1, 2012, the Guardian published the article Revealed: the day Obama chose a strategy of silence on climate change, which reported that “many believe the White House was wrong when it decided in 2009 that climate change was not a winning political message.” While the non-profit industrial complex puts forward the illusion they are representing civil society in regard to critical issues such as climate change, the reality is far different. Rather, the complex is simply an extension of the state. Jessy Tolkan, who at the time was a leader of the 350.org-led climate youth movement, Power Shift, conveys this reality in no uncertain terms: “My most vivid memory of that meeting is this idea that you can’t talk about climate change.” Present at this meeting were Bill McKibben, Betsy Taylor and Van Jones of 1Sky/350.org.

The rightwing pundits are also taking note of where 350.org gets its financial support. From the February 14, 2013 Financial Post article Rockefellers behind ‘scruffy little outfit:

“By my analysis of information from the U.S. Foundation Center and the tax filings of American charitable foundations, McKibben’s campaigns have received more than 100 grants since 2005 for a total of US$10-million from 50 charitable foundations. Six of those grants were for roughly US$1-million each….

“Since 2007, the Rockefellers have paid US$4-million towards 1Sky and 350.org, tax returns say. The Schumann Center provided US$1.5-million to McKibben’s three campaigns as well as US$2.7-million to fund the Environmental Journalism Program at Middlebury College, in Vermont, where McKibben is on staff….

“What 350.org’s list of donors fails to convey is that some foundations provide only US$5,000 or US$10,000, while two unidentified donors provide half of 350.org’s budget for 2011, according to its financial statements. Four grants accounted for two-thirds of 350.org’s budget. 350.org declined to identify the donors of those grants….

“During 2011, the most recent year for which tax returns are publicly available, 350.org again had a US$2-million payroll, including US$622,000 for consultants.”

2011: Bill Gates – Now the Largest Single Shareholder in CN Rail

“CN has been rolling 10,000 tons of tar sands crude every day to the Gulf of Mexico for Altex Corp. since October 2011.” — March 19, 2011, Beyond Enbridge, alternatives arise for increasing West Coast shipments

Above image: Warren Buffett, chairman of Berkshire Hathaway Inc., right, and Bill Gates, chairman and co-founder of Microsoft Corp., participate in a newspaper toss event at the Berkshire Hathaway annual shareholders meeting in Omaha, Nebraska, on May 5, 2012. [Source: Billionaires Worth $1.9 Trillion Seek Advantage in 2013]

“Bill Gates, Warren Buffett visit Alberta oilsands. Two of the world’s richest people, Microsoft Corp. founder Bill Gates and his friend, American investment magnate Warren Buffett, quietly flew into northeastern Alberta on Monday, where they took in the oilsands, apparently with awe.” — Calgary Herald, August 19, 2008

Bill Gates has been actively investing in Canadian Nation (CN) for years (since approx. 2000) while, simultaneously, CN has been building its power through rapid acquisitions that include provincially-owned BC Rail, positioning itself as the sole rail carrier in northern British Columbia. In 2006, Canadian National railway stock represented approx. $1.4 billion of Gates’ $3.4 billion investment portfolio. With an influx of money, CN seized the opportunity, acquiring a set of short-line railways in Northern Alberta as well as the Athabasca Northern Railway that connected Fort McMurray to Edmonton. [4]

In 2004, Bill Gates became a director of Berkshire Hathaway, the only corporation outside of his own, Microsoft, of which he is a director. Bill Gates’ Cascade Investments LLC is the second largest shareholder of Berkshire and owns more than 5% of class B shares. [5]

On March 21, 2008 it was reported that “the Bill & Melinda Gates Foundation’s trust will sell more than half its nearly 1 million shares of Berkshire Hathaway brkb stock to comply with federal tax rules, according to a Securities and Exchange Commission filing.” This move was strategic in order to appease federal excise tax rules, which limit excess business holdings by private foundations. The rules surrounding Buffett’s gift now require the Gates Foundation to give away the dollar amount of its annual contribution, so the stock sales are likely being done to satisfy that requirement. [Aug 10, 2009]

April 24, 2011 Canada’s Globe and Mail reports: “Bill Gates owns a $3.2-billion train set, making him the largest shareholder in Canadian National Railway Co. …. ‘He has been gradually buying more CN stock,’ RBC Dominion Securities Inc. analyst Walter Spracklin said.”

As of November 19, 2012 Insider Monkey reports “Berkshire Hathaway Inc. (NYSE:BRK.B) continues to be the trust’s [the Bill and Melinda Gates Trust Foundation’s] largest holding, now worth 47.5% of its entire 13F portfolio. During 3Q, the trust increased its share count by 14%. A big part of the overwhelming presence of Berkshire is Warren Buffett’s donation of shares. Berkshire shares act much like a traded investment fund, and do not attract many hedge funds as a result. Even with a beta [7] of 0.5, Berkshire has managed to outpace the market (S&P 500) year to date by three percentage points. Check out all of Warren Buffett’s Berkshire holdings.” [Emphasis added.]

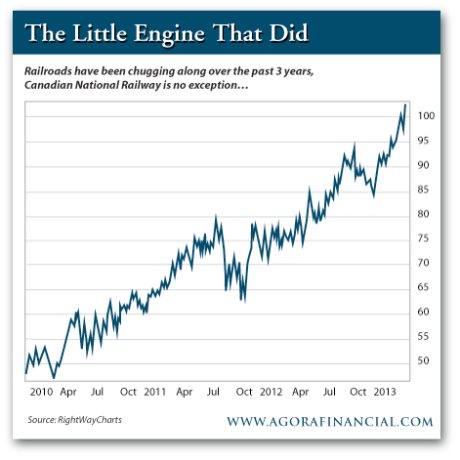

Canadian National (CN) Railway Performance since 2010:

The above chart on left makes clear CN’s formidable stock performance since Buffett acquired BNSF in late 2009. [Read more: “If Buffett Were Canadian, He’d Want This Stock” (Canadian National)]

CN in the Media

April 9, 2009, CN idea a winner for oil sands:

“The energy and geopolitical ramifications of Canadian National Railway’s ‘Pipeline on Rails’ initiative is a game-changer for Canada… Within months, CN will be shipping 10,000 barrels daily from producers whose reserves are now stranded. The railway will deliver the oil sands production through the use of insulated and heatable railcars or by reducing its viscosity by mixing it with condensates or diluents.

But the “scalability” of the concept – up to four million barrels per day – means that the railway can ramp up production vastly by just adding rail cars. Shipping four million barrels a day is possible with current rail capacity.” [Emphasis added.] [Note that this article in slightly altered versions appeared on several websites as the author, Diane Francis, is an American who is Editor at Large with the Canadian National Post and holds corporate directorships. Source: Huffington (Time-Warner) profile. Also note that the original article appears to have been edited.]

February 7, 2011, the Globe & Mail:

“[CN] has begun sending oil sands bitumen to California; heavy oil from Cold Lake, Alta., to Chicago and Detroit; and crude from the Bakken, a fast-growing play in southern Saskatchewan, to the U.S. Gulf Coast…. CN boasts that its tracks lie within 80 kilometres of five million barrels a day of refining capacity, which is more than double Canada’s entire U.S. exports…. ‘There’s a lot of talk about is it pipe? Is it rail?’ Mr. Cairns said. ‘Our view is pretty simple. It’s a big pie. … It’s not either or. It’s maybe both.'” [Cairns is CN’s vice-president of petroleum and chemicals.]

Jan 23, 2012, Buffett’s Burlington Northern Among Pipeline Winners:

“‘CN continues to work closely with customers in Alberta to capitalize on oil-and-gas related opportunities,’ the Montreal-based company said. ‘CN sees potential for the outbound movement of oil sands products such as bitumen and synthetic crude to refineries in the U.S. Gulf Coast region, or eventually through West Coast ports to offshore markets.'”

Nov 10, 2012, Rail’s new oil rush: Calgary firm will ship via CN to U.S:

“‘I think Canadians are going to have a much more difficult time getting crude to market than we may expect and that’s because of the delays in the (Northern) Gateway and Keystone (pipelines),’ said Byron Lutes, chief executive of Southern Pacific…. Unlike pipelines, that means no public hearings and no environmental protests. As recently as two years ago, CN didn’t haul any crude. It now projects moving 30,000 carloads in 2012. This week it announced its latest project with partner Arc Terminals LP to build an off-loading facility in Mobile, Ala., for crude destined for Gulf Coast refineries. Canadian Pacific moved 500 tank car loads a year in North Dakota in 2009, but now expects an annual rate of 70,000 carloads, 46 million barrels by 2013 throughout its system. The firm behind Southern Pacific’s project is Calgary-based Altex Energy, which at one time was promoting a pipeline between Alberta and Texas. It is now building rail terminals, an idea that appeals to small firms that don’t want to sign 20-year pipeline contracts. With its new project, Southern Pacific is slowly ramping up. McKay [Thermal Project dedicated rail terminal] expects produce [sic] up to 12,000 barrels per day of bitumen and a 6,000 bpd expansion is being planned. Under the contract with Altex, CN and Genesis Energy in the U.S., more than 12,000 car loads each year will be heading to Mississippi in the 500 rail cars Southern Pacific has leased, equal to about 10 crude unit trains per month on a two-week return trip. Initially the bitumen will be trucked to Southern Pacific’s new terminal, but it is hoped a rail spur might eventually be built to the McKay site, which is 45 kilometres northwest of Fort McMurray.” [Emphasis added]

The oligarchy’s firm grip on society is never left to chance. No group of people is as organized, disciplined and united in protecting their own pathological pursuit of money at the expense of people and planet. How long the oligarchs have been planning acquisition and expansion of rail is not clear, yet one can safely assume the February 2009 backlash to the TransCanada application for the Keystone XL tar sands pipeline led by NGOs presented the opportunity for a new stream of wealth, domination and capture. One can also speculate that the fate of the first pipeline application had already been determined at this point.

2012: Bill Ackman – Now the Largest Single Shareholder in CP Rail

Perhaps of no surprise is the fact that, as of 2012, Bill Ackman, founder and CEO of the hedge fund Pershing Square Capital Management is now the largest single shareholder in CP (Canadian Pacific) Rail. Along with Gates, Clinton and Buffett (number one, two and five respectively), Ackman comes in at number three for the world’s “50 most influential ultra high net worth individuals” by Wealth-x, which estimates the value of Ackman’s sphere of influence at $194 billion. [More on Ackman and CP in the second installment of this series.]

Section II

The Enablers | 350.org et al

Image: Posted by 350.org,11/10/11. “After an epic campaign, the incredible coalition fighting the Keystone XL tar sands pipeline has emerged victorious. The pipeline – the fuse to “the largest carbon bomb on the planet” – has been delayed and effectively killed.” ? 350.org 2011 Annual Report

The Keystone XL pipeline, proposed by TransCanada, based in Calgary, Alberta, would initially move 700,000 barrels. 350.org et al argue that keeping that oil out of the United States would slow tar sands development. Yet in a global industrialized capitalist system dependent upon continued growth, this argument is not based on logic, rather it is based on denial, coupled with the continuous task of the non-profit industrial complex to protect the economic system using strategic discourse.

It is not as though NGOs within the non-profit industrial complex have no clue regarding the rail industry quietly burgeoning behind the KXL campaign. It is quite the contrary. In the final Environmental Impact Statement (EIS) it is stated that “Even in a situation where there was a total freeze in pipeline capacity for 20 years, it appears that there is sufficient capacity on existing rail tracks to accommodate shipping … through at least 2030…. [S]tatistics from the Department of Transportation … conservatively estimated that the existing cross-border rail lines from Canada to the U.S. could accommodate crude oil train shipments of over 1,000,000 bpd (barrels per day).” (Note the language used within this paragraph implies rail is an option rather than a reality already in full force.)

March 19, 2011, Beyond Enbridge, alternatives arise for increasing West Coast shipments:

“‘This is really a campaign against tar sands expansion rather than a single pipeline,’ responds Susan Casey-Lefkowitz, director of the international program at the Natural Resources Defense Council. ‘I think it’s fair to say that we don’t really want British Columbia to be a gateway for oilsands oil,’ summarises Greenpeace campaigner Stephanie Goodwin. When it comes to rail shipments or Kinder-Morgan expansion… ‘What we’d likely be seeing is the same kind of opposition that Enbridge is experiencing.'”

July 28, 2011, Rail Makes A Comeback:

“A spokeswoman for national railway BNSF would not disclose specific numbers, but said that the amount of Bakken oil it was hauling, as well as the destinations, had doubled in the past year…. Late last year, pipeline and midstream company Kinder Morgan invested $150 million in Watco, a short-line railroad holding company. The two have since announced several projects.”

Summer-2011-Vol21-No3 , Watershed Sentinel, Tar Sands Express – Enbridge Northern Gateway Pipeline or the Railway? Or Both?

“Now it’s increasingly looking as though the pipeline may have been a ruse all along (a classic ‘bait and switch’), with a number of PR payoffs – as a political bargaining chip with the US on oil security and supply; as a distraction from what the railways have been planning; and as a diversion from the quiet expansion of Kinder Morgan’s Trans Mountain pipeline, which has resulted in rapidly increased oil tanker traffic through the Gulf Islands. Kinder Morgan plans to more than double the capacity of its pipeline to Vancouver’s Westridge terminal, which would result in more than 150 oil tankers per year plying the dangerous waters near Second Narrows. Starting on August 22, the NEB will begin public hearings into Kinder Morgan’s bid for long-term shipper commitments for pipeline expansion. Enbridge’s Northern Gateway seems to have been the ‘bait,’ with the ‘switch’ to pipeline-on-rails and Kinder Morgan’s TransMountain pipeline to occur at an expedient political moment.”

Jan 20, 2012, More ND oil will be railed with no US pipeline:

“Wayde Schafer, a North Dakota spokesman for the Sierra Club, said Obama’s decision was appropriate though oil that would have moved on the pipeline will be transported by environmentally riskier rail or trucks. ‘There is no question that oil by rail or truck is much more dangerous than a pipeline, but then again, you have to have adequate time and you have to site a pipeline appropriately or you’re just asking for trouble,’ Schafer said. Hamm’s Enid, Okla.-based company is one the oldest and biggest operators in North Dakota’s booming oil patch, which incorporates most of the Bakken and underlying Three Forks formations. Hamm said most of his company’s production already is shipped by rail. If the Keystone XL is not built, oil production will be slowed in North Dakota but the domestic oil will be more valuable without the competition from Canadian crude, he said.” [Emphasis added]

Jan 23, 2012, Buffett’s Burlington Northern Among Pipeline Winners:

“With modest expansion, railroads can handle all new oil produced in western Canada through 2030, according to an analysis of the Keystone proposal by the U.S. State Department…. Rail car production is already at a three-year high as manufacturers such as Greenbrier Cos Inc. (GBX) and American Railcar Industries Inc. (ARII) expand to meet demand for sand used in oil and gas exploration, according to Steve Barger, an analyst at Keybanc Capital Markets Inc. in Cleveland, citing Railway Supply Institute statistics. Railroads are being used in North Dakota (STOND1), where oil producers have spurred a fivefold increase in output by using intensive drilling practices in the Bakken, a geologic formation that stretches from southern Alberta to the northern U.S. Great Plains. During 2011, rail capacity in the region tripled to almost 300,000 barrels a day as higher production exceeded what pipelines handle, according to the State Department report on Keystone XL.” [Emphasis added]

March 3, 2013, Canadian crude oil finds a new pathway through Minnesota:

“Anthony Swift, an attorney for the Natural Resources Defense Council and co-author of one of the critical pipeline safety reports, said railroads don’t offer a feasible alternative to pipelines from Canada. He said tar sands producers aim to triple oil output by 2030, which would outstrip railroads’ capacity. But the U.S. State Department, in a report on Keystone XL issued Friday, said ‘the proven ability of rail to transport substantial quantities of crude oil profitably’ means that denial of the project ‘is unlikely to have a substantial impact on the rate of development in the oil sands, or on the amount of heavy crude oil refined in the Gulf Coast area.’

“As anti-pipeline groups have pressed the White House to kill the project, the oil and railroad industries have been building oil-loading terminals and buying tank cars to ship Canadian crude oil by rail. ‘There is no permitting required – you can put oil on rail and nobody can complain,’ said Sandy Fielden of RBN Energy, a Houston-based consulting firm that has tracked the oil-by-rail boom. In the campaign against Keystone XL, the National Wildlife Federation and other groups have issued two reports since 2011 critical of pipeline safety, singling out Canada’s heavy oil called bitumen as especially hazardous. Neither report mentioned the risks of shipping it by rail. Yet the dramatic growth of the crude-by-rail business in North America illustrates how quickly shippers can adapt to a new option. North Dakota, the nation’s No. 2 oil-producing state behind Texas, ships the majority of its oil by rail from loading terminals built mostly in the past three years.

“‘Essentially the safest way to transport the product is in pipelines,’ said Jim Hall, a former chairman of the National Transportation Safety Board and now a safety consultant. ‘I would be concerned in populated areas where I saw an increase in hazardous materials placed in tank cars and on the rails.'”[Emphasis added]

March 6, 2013: Still Months from a Decision, Keystone XL Debate Rages On:

“There was an interesting twist in the State Department’s report however, regarding a third option being presented if KXL wasn’t built. Rather than fully committing to building or not building the pipeline, the State Department analyzed the concept of improving railway transportation to ramp up distribution and cater the transfer of oil away from Western Canada and the central US to the coastlines.

“Some are quick to dismiss this notion, believing that this is a tactic to convince people it’s feasible. In 2011, 350.org spokesman Daniel Kessler detailed how rail shipment only made up for .69% of all western Canadian oil supply. He added, ‘Transporting oil sands by rail grabs headlines but will likely remain a very small percentage of total shipped oil sands…even if there was a massive increase in rail transport – it will remain a niche service for oil sands producers.’

“Susan Casey-Lefkowitz, director at the Natural Resources Defense Council, agrees with Kessler on how rail would not be able to keep up with distribution from a pipeline. She said, ‘Keystone XL is a driver of expansion…rail doesn’t appear to be an alternative for the quantities that will be transported by Keystone XL.’

“It’s really as simple as going down the list of recent statistics supporting the latest influx of rail distribution. Plains All American Pipeline, a major transporter of oil and gas in the US, is doubling its domestic crude oil rail capacity. Canadian National Railway said last week they expect to double their crude shipments this year as well. In Canada, there’s an 18 to 24 month waiting period for new tank cars. The State Department announced in the report that there’s an additional 48,000 rail cars on back order in North America, too.

“The State Department report had this to add as well, ‘in the past two years, there has been exponential growth in the use of rail to transport crude oil throughout North America, primarily originating from the Bakken in North Dakota and Montana, but also increasingly utilized in other production areas.’ Based on figures from Justin Kringstad, director of the North Dakota Pipeline Authority, in five years time the Bakken Formation has seen a jump from zero to 550,000 barrels a day in production, all transported by rail. And for the record, it’s widely believed that the Keystone XL pipeline would have the capacity to deliver 830,000 barrels of oil per day.” [Emphasis added]

Articles published on May 1, 2012 and May 5, 2012 make it clear that although 350.org activists protested to stop Warren Buffett’s coal trains, there is still zero mention within the non-profit industrial complex of shipping oil via rail.

If completed, the Keystone XL pipeline would add 830,000 barrels per day, increasing the total capacity up to 1.1 million barrels per day [This is the current figure on the TransCanada Keystone XL website. Initially, the figure was 510,000 barrels per day. It was adjusted/increased in 2012]. By contrast, March 7, 2013: “At the same time, oil shipments by rail have soared, along with the increase in domestic crude production, up about 1 million barrels in the past year. BNSF CEO Matt Rose said the railroad now ships 525,000 barrels a day and expects that to grow to 700,000 barrels by the end of the year. Shipments could reach 1 million barrels in the next 18 months” [http://www.cnbc.com/id/100530572].

Oil via rail is booming. One may think this is an important development in the 350.org Stop the XKL! campaign. But when one searches the 350.org website for the words “rail” and “BNSF,” these key words yield a mere three results. All three focus on coal only.

Reality can be quite frustrating when it gets in the way of a great campaign. No one wishes to see this reality, as most are not interested in hearing anything other than the whirring of their master.

Tar Sands Proliferation by Proxy

Dog & Pony Show

But let’s be careful not to put words in people’s mouths. When the campaign was officially launched on Nov 5, 2010 (Coalition Launches Nationwide Advertising Campaign Calling for Obama to Stop Oil Pipeline), it was quite clear that shutting down tar sands production was not (nor is it now) the intent. Rather, the official coalition states: “The No Tar Sands Oil campaign is an effort to stop the expansion of the Canadian tar sands, advocate for its clean up and propel new energy alternatives“] [Preview here.] “Stop the KXL!” would effectively replace the grassroots call of “Shut Down the Tarsands!” – a slogan whereby the intent was crystal clear. In other words, this new campaign would become a friend to industry as well as the necessary diversion that distracted the populace from root causes of a warming planet, ecological collapse and the non-negotiable requirements to mitigate climate change that the progressive greens deny and undermine to the very best of their well-financed ability.

In Canada, the KXL sister campaign, “Defend our Coast” (led by Greenpeace, Council of Canadians and 350.org), used similarly crafted language claiming “[T]ogether we will stop the expansion of tar sands tankers and pipelines to the West Coast.” Council of Canadians, working hand in hand with 350.org on this pipeline campaign, makes their cautious position clear stating:

“Our campaign is an extension of our ongoing Energy and Climate Justice work. We continue to call on governments to ensure Canadians’ energy security and work to transition off fossil fuels, including the unsustainable development of the tar sands. Limiting additional pipeline capacity will force a slowdown of the current relentless pace of tar sands development. We approach the climate change crisis from a justice perspective, seeking to address its root causes, which include unsustainable production, consumption and trade that are driven by corporate-led globalization. Real solutions to the climate crisis must be based on democratic accountability, ecological sustainability and social justice.” [Emphasis added]

Of course, this is nothing new. We have witnessed such faux “victories” before. Yet, most remain unaware that many of the big greens behind the Tar Sands Action campaign (including RAN, Greenpeace, and the David Suzuki Foundation) are the same organizations that sold out the Boreal Forest in 2008 and 2010. (View this insightful 1 minute video with Greenpeace below or here.)

http://youtu.be/GKC8OQmDtXk

Defend our Coasts Capitalists

Not to worry – like all savvy capitalists, Buffett has all of his T’s crossed. If or when the KXL is approved, BNSF will profit from this venture as well: “A South Dakota state government document shows that BNSF and TransCanada Keystone Pipeline, LP entered into a Pipeline License Agreement on August 1, 2008. The Agreement called for BNSF to carry pipeline materials from South Dakota up to the Alberta tar sands.” And although tank cars won’t completely replace pipelines in North America, with a populace addicted to oil with an appetite for consumption and waste that is nothing less than voracious, even if the $5 billion Keystone XL is approved the demand for crude via rail will continue due to the fact that 1) it takes years to build pipelines and 2) the head start afforded to Gates and Buffett ensures the burgeoning rail industry will dominate the market.

All Roads Lead to Rail

“You’re seeing an unprecedented level of opposition to these pipeline projects.” — Nathan Lemphers, an analyst with the Calgary-based Pembina Institute

Also underway is a $10.4-billion plan to construct a 2,400-km “purpose built” railroad to transport oil from Alberta to Alaska, where it would be shipped overseas via tankers.

Buffett is nothing less than brilliant. Deliberate delay of the KXL has resulted in much of Canada’s oil landlocked while America’s oil capacity (and power) expands. It is of little surprise that US corporations, via foundations, are distributing millions of dollars to NGOs and grassroots groups to keep the KXL and other pipelines at bay.

It is very clear why we are witnessing an unprecedented level of opposition to these pipeline projects; to divert attention away from the burgeoning rail industry. The only question is, when will we acknowledge the fact that we have once again been manipulated by those who claim to speak for civil society, but actually serve to protect the system and, by extension, their funders, without whom the manipulators extraordinaire would cease to exist?

A four-million-barrel-via-rail capacity would be roughly equal to that of 6 pipelines. Whereas pipeline infrastructure may take years to complete, expanding rail capacity is easy: build some terminals and simply purchase more tanker cars and engines. A single train can carry approx. 110 tanker cars. The estimated cost on expanding rail infrastructure is roughly 1/10th of the capital required to expand pipeline infrastructure.

One thing is clear to those willing to face an uncomfortable reality. Under the current economic system – that of industrialized capitalism – oil producers will find a way to deliver it to customers one way or another.

You can almost hear Buffett, Gates and Obama laughing as they toast to our collective belief in the non-profit industrial complex funded and utilized (and in many cases created) to further corporate dominance. While everyone is bedazzled by McKibben et al claiming victory in the Keystone debacle, Buffett and Gates are laughing all the way to the Cayman Islands.

Smoke and Mirrors

Barrack Obama is a charismatic smokescreen for the oil industry. Utilizing his charisma, he safeguards his toxic neighbor to the north, Canada, protecting it from US public scrutiny. For its part, Canada has quietly played a vital role in tar sands expansion via rail utilizing the corporation Canadian Natural Resources Ltd Board of Directors [6], which includes Gordon D. Griffin, former US Ambassador to Canada (1997-2001), director of CIBC, Transalta Corp., Canadian National Railway, and registered US lobbyist for Nexen Energy Inc., part of Syncrude.

For a moment, try to imagine the progressive greens if this same scenario was unveiling itself under the (Republican) Bush administration. Organizations such as 350.org would be having a field day. Yet, with a Democratic administration and a Black American president in the White House, the dominant left organizations have never found it so easy to protect capitalism and white privilege via strategic discourse. The native peoples who live on much of the poisoned land and endure much suffering, are used for beautiful “Stop KXL!” photo-ops all while oil mining, refineries and fracking continue to flourish and expand at an unprecedented rate. An important question that must be asked is this: Why do people continue to believe that NGOs such as 350.org/1Sky that are initiated and funded by Rockefeller Foundation, Clinton Foundation, Ford, Gates, etc. would exist to serve the people rather than the entities that create and fund them? Since when do these powerful entities invest in ventures that will negatively impact their ability to maintain power, privilege and wealth? Indeed, the oligarchs play the “environmental movement” and its mostly well-meaning citizens like a game of cards.

Tar sands via rail is a reality that none of these public relations people disguised as progressive greens will address, let alone, confront. Yet it is our reality nonetheless.

Condensed TimeLine:

- June 25, 2006: Buffett pledged to donate most of his wealth to the foundation established by Microsoft Corp. co-founder Bill Gates and his wife, Melinda Gates, as well as other “philanthropic” organizations.

- 2007: 1Sky (officially merging with 350.org in April of 2011) is created by the Clinton and Rockefeller foundations in collaboration with “progressive greens.”

- 2007: Warren Buffett’s Berkshire Hathaway begins to acquire the Burlington Northern Santa Fe railroad stock.

- 2007: 60% of Marmon Holdings (Union Tank Car Co.) was acquired by Buffett’s Berkshire Hathaway, with the remaining 40% to be acquired in the next five to seven years.

- Feb 7, 2008, Financial Post quoting Warren Buffett “The tar sands are probably as big a potential source of production 15 to 20 years from now. It would surprise me if the world wasn’t wanting to use 200 million barrels per day [of oil] in 15 or 20 years. The tar sands are the biggest single possibility to fill the gap that, it looks like, will otherwise develop in the next decade or two.”

- 2007-2008, Warren Buffett: advisor to Barack Obama and major financial backer/supporter of Hilary Clinton [Sources: Aug 16, 2007, June 27, 2007, March 28, 2008, Dec 9, 2007, May 19, 2008, July 3, 2008, July 19, 2011]

- Aug 19, 2008: Warren Buffett and Bill Gates make a quiet visit to the Alberta tar sands.

- Railway Magazine Nov/08: Burlington’s Manager of Businesses Development, Jane Halvorson, identified an “opportunity to offer rail service as an alternative to pipelines to get the bitumen blend to the refineries.” Depending, she added, on “partnerships with the Canadian railroads.”

- Cont’d, Nov./Dec. 2008: BNSF document: “Alberta oil sands: No sour deal.”

- Sept 19, 2008: TransCanada submits application to State Department for a Presidential Permit for the Keystone XL tar sands pipeline. The State Department commences the environmental review process.

- Feb 2009: Thousands of citizens, including many who live along the pipeline route, express to the State Department serious concerns about the proposal in public hearings and in written comments.

- April 9, 2009: Game-changer: Canadian oil sands will bypass US for Asia

- April 11, 2009: CN idea a winner for oil sands

- August 2009: US State Department approves the Enbridge’s Alberta Clipper Pipeline, a key tar sands pipeline. 350.org et al are silent.

- Nov 3, 2009: Warren Buffett’s Berkshire Hathaway proposes to purchase BNSF Railway as a wholly owned subsidiary for $34 billion in the largest deal in Berkshire history. As of June 2009, Berkshire Hathaway was the eighteenth largest corporation on Earth.

- Feb 4, 2010: 86 US organizations call on President Obama to reject the pipeline.

- June 19, 2010: Midwestern Crude Oil Moving In Unit Trains Again

- July 14, 2010: Obama Meets With Buffett to Discuss Economy, Jobs

- Nov 5, 2010: COALITION LAUNCHES NATIONWIDE ADVERTISING CAMPAIGN CALLING FOR OBAMA TO STOP OIL PIPELINE [“The No Tar Sands Oil campaign is an effort to stop the expansion of the Canadian tar sands, advocate for its clean up and propel new energy alternatives“][Emphasis added.]

- Dec 14, 2010: Obama Meets With Buffett and the Gates

- Feb 7, 2011 – CN, CP push for a “pipeline on rails”

- Feb 15, 2011: Obama Honors Buffett, Bush With “Medal of Freedom”

- April 24, 2011: Bill Gates largest shareholder in Canadian National | “Bill Gates owns a $3.2-billion train set, making him the largest shareholder in Canadian National Railway Co.”

- July 28, 2011: Rail makes a comeback in moving oil around the US

- Summer 2011, Tar Sands Express – Enbridge Northern Gateway Pipeline or the Railway? Or Both?

- Summer 2011: Is the Real Gateway Pipeline on Rails?

- August 23, 2011: Obama Talks to Buffett About Economy in Preparation for Speech

- Sept 21, 2011: Buffett to host high-profile fundraiser for Obama ($35,800 per person)

- Nov 3, 2011: Oil aboard! Railroads shipping more Alberta crude

- Jan 8, 2012: Gates and Buffett All Aboard With Railroads

- Jan 20, 2012: More ND oil will be railed with no US pipeline

- Jan 23, 2012: Demise of Keystone XL Means More Bakken Shale Gas Flarin

- Jan 23, 2012: Buffett’s Burlington Northern Among Pipeline Winners

- January 24, 2012: Warren Buffett cleans up after Keystone XL

- January 2012: BNSF expects shales, domestic intermodal and other promising sectors to propel 2012 traffic beyond GDP-growth levels

- Feb 1, 2012: Buffett Railroad Boosts Capital Plan to $3.9B

- Feb 1, 2012: Ridin’ the Bakken Slow Rail

- Feb 3, 2012: Warren Buffett Exposed: The Oracle of Omaha and the Tar Sands

- March 1, 2012: Buffett Poised to Win Bet on U.S. With Burlington

- March 24, 2012: BNSF Galesburg Yard’s New Tracks Are In Service | “Okay, it’s time to reveal the big secret.”)

- April 18, 2012: The love affair continues: Warren Buffett’s Time 100 tribute is written by… Barack Obama

- May 2, 2012: BNSF plans $202 million capital program in Nebraska

- May 17, 2012: How Bill Ackman drove in the last spike at Canadian Pacific Railway

- May 18, 2012: Video: Canada’s newest pipeline: the train

- June 27, 2012: Southern Pacific Resource Corp. completes arrangements to transport and market bitumen via CN to the U.S. Gulf Coast

- Aug 8, 2012: Oil shipments are Albany-bound – North Dakota crude will be shipped by rail to port, loaded on barges

- August 16, 2012: Keystone XL pipeline construction begins amid protests

- August 21, 2012: Railways ship bitumen to relieve pipeline bottlenecks

- Sept, 2012: Shale Oil and Gas: Revitalizing Inland Transportation Networks

- Sept 4, 2012: BNSF Expands Bakken Oil Transport Capacity to One Million Barrels per day

- Sept 10, 2012: How Bill Ackman drove in the last spike at Canadian Pacific Railway

- Oct 8, 2012: Warren Buffett And Carl Ichan Are Investing In Fuel Refiners

- Oct 8, 2012: Oil On the Tracks: How Rail Is Quietly Picking Up the Pipelines’ Slack

- Nov 6, 2012: CN Rail, CP Rail surging with crude oil moving by trains

- Nov 8, 2012: Video: Canada’s pipelines: Beyond Gateway and Keystone

- Nov 10, 2012: Rail’s new oil rush: Calgary firm will ship via CN to U.S

- Nov 17, 2012: Former Clinton and Bush Cabinet Members, Now Oil and Gas Lobbyists, Expect Keystone XL Green Light

- January 3, 2013: UPDATE 1-U.S. petroleum rail shipments up nearly 50 pct in 2012

- January 3, 2013: Buffett Like Icahn Reaping Tank Car Boom From Shale Oil

- Jan 6, 2013: Questions loom over railway to Alaska to ship Alberta tar sands oil

- January 7, 2013: Alberta bitumen makes it to Mississippi by rail

- Jan 14, 2013, North American energy companies are starting to invest more in railroad terminals than the railroads themselves

- Jan 22, 2013: Railroads hauling oil plant their flags in pipeline territory

- Jan 22, 2013: Video: Nebraska approves new route for Keystone XL pipeline

- Feb 5, 2013: Macleans Canada: Oil Sands Bust

- Feb 6, 2013: Crude loves rocking rail – The year of the tank car

- Feb 16, 2013: Oil Aboard! Tar Sands Industry Eyes Nexen Rail Alternative to Stalled Pipelines

- Feb 18, 2013: Price differentials boost rail transport of blended bitumen

- Feb 27, 2013: Threats to the Environment and the XL Keystone Project: “It’s Not About Oil Pipelines, It’s About Tar Sands”

- March 01, 2013: Sens. Lautenberg and Rockefeller introduce transportation investment bill

- March 3, 2013: Canadian crude oil finds a new pathway through Minnesota

- March 5, 2013: Buffett Says Gloat Like Rockefeller When Watching Trains

- March 6, 2013: If Buffett Were Canadian, He’d Want This Stock (Canadian National)

- March 6, 2013: Still Months from a Decision, Keystone XL Debate Rages On

- March 7, 2013: Berkshire’s Oil Hauling Railroad Tests Switch to Natural Gas

- March 9, 2013: Buffett Wins Big From Railroad Crude Shipments

- March 15, 2013: Moving bitumen to market: the case for rail

- April 2, 2013: Oil patch rides the rails to price surge

Yes. “Reports make it official: Oil and gas are booming.” [April 4, 2013]

This is what happens when you protect the powers that bribe you and keep you quiet. The plutocrats successfully bought the right to kill the planet and its people. All it took was a lot of money.

Do we grasp this yet? Can we finally understand there is always a core and fundamental reason that the oligarchy (via their tax exempt foundations) creates and funds unsustainable NGOs that, like any entity dependent on economic growth, will collapse outside of the capitalist system? The oligarchy and the non-profit industrial complex form a pathological co-dependent relationship where reality is denied by the less powerful partner: the inter-reliant NGO.

Next: The Art of NGO Discourse, Part II

EndNotes:

[1] According to Energy Tribune, Valero Energy Corp. has been awarded multiple multimillion-dollar contracts by the U.S. Defense Energy Support Center (DESC) in order to provide fuel to Israel. [Source: Wikipedia] [2] On July 2, 2008, Buffett attended a $28,500 per plate fundraiser for Obama’s campaign in Chicago hosted by Obama’s National Finance Chair, Penny Pritzker and her husband, as well as Obama advisor Valerie Jarrett. Buffett backed Obama for president, and intimated that John McCain’s views on social justice were so far from his own that McCain would need a “lobotomy” for Buffett to change his endorsement. Buffett was also finance advisor to California Republican Governor Arnold Schwarzenegger during his 2003 election campaign. [Wikipedia] [3] On June 25, 2006, Warren Buffett (then the world’s richest person, estimated worth of US$62 billion as of April 16, 2008) pledged to give the Gates foundation approximately 10 million Berkshire Hathaway Class B shares spread over multiple years through annual contributions, worth approximately US$1.5 billion for the year 2006. Buffett set conditions so that these contributions do not simply increase the foundation’s endowment, but effectively work as a matching contribution, doubling the Foundation’s annual giving: “Buffett’s gift came with three conditions for the Gates foundation: Bill or Melinda Gates must be alive and active in its administration; it must continue to qualify as a charity; and each year it must give away an amount equal to the previous year’s Berkshire gift, plus another 5 percent of net assets. Buffett gave the foundation two years to abide by the third requirement.” The Gates Foundation received 5% (500,000) of the shares in July 2006 and will receive 5% of the remaining earmarked shares in the July of each following year (475,000 in 2007, 451,250 in 2008). [Wikipedia] [4] “The entity overseeing Bill Gates’ personal investment portfolio is Cascades Investment LLC, based in Kirkland, Washington. By 2006, the stock portion of Cascade’s portfolio was worth about $3.4 billion, with $1.4 billion of that invested in shares of Canadian National Railway Co. (CN). CN bought up provincially-owned BC Rail in 2004, a controversial decision by then-Premier Gordon Campbell that made CN the only rail carrier in Northern BC – a decision that continues to rankle much of the electorate. In 2006, CN bought 2 short-line railways in Northern Alberta: Mackenzie Northern Railway in the northwest and the Lakeland & Waterways Railway in the northeast. By the time of the Buffett/Gates visit, CN had also purchased Athabasca Northern Railway Ltd., linking Fort McMurray to Edmonton.” [Source] [5] A classification of common stock that may be accompanied by more or fewer voting rights than Class A shares. Although Class A shares are often thought to carry more voting rights than Class B shares, this is not always the case. Companies will often try to disguise the disadvantages associated with owning shares with fewer voting rights by naming those shares “Class A,” and those with more voting rights “Class B.” [Source: Investopedia] [6] “Canadian Natural’s board of directors is helpful. Four are especially noteworthy: there’s Frank J. McKenna, former premier of New Brunswick, former Canadian Ambassador to the US (2005-2006), and a director of Brookfield Asset Management Inc. There’s Gary Filmon, former premier of Manitoba, chair of Canada’s Security and Intelligence Review Committee, and director/trustee of several income funds. There’s Catherine M. Best, a director of Enbridge Income Fund Holdings Inc. And there’s Gordon D. Griffin, former US Ambassador to Canada (1997-2001), director of CIBC, Transalta Corp., Canadian National Railway, and registered US lobbyist for Nexen Energy Inc., part of Syncrude.” [Source] [7] A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), a model that calculates the expected return of an asset based on its beta and expected market returns. [Source: Investopedia]

2 Comments

powerful investigation and presentation; you make your case, convincingly.