Apr 23

20200

"pay for success" ARK Azure Blockchain Citigroup cloud computing software Deutsche Bank Development Impact Bond (DIB) Working Group digital identity Eugenics GAVI Genetic Engineering Goldman Sachs. health passports impact data Impact Investing Alliance International Development Innovation Alliance Johns Hopkins Johnson & Johnson JP Morgan Lehman Brothers Lions Head Partners medical robots Michael Bloomberg Microsoft MIT Moderna mRNA platforms Omidyar Network OPIC quantum dot vaccine tattoos Rockefeller Foundation Social Impact Bonds trans-humanism UK Charter School UKAID USAID vaccine bonds WHO World Bank

Vaccines, Blockchain and Bio-capitalism

April 19, 2020

By Alison McDowell

Source of featured image here.

Vaccine Markets

Pay for success finance deals will be well served by the global vaccine market that is being advanced through Gates’s outfit GAVI. Vaccine doses are readily quantifiable, and the economic costs of many illnesses are straightforward to calculate. With a few strategic grants awarded to prestigious universities and think tanks, I anticipate suitable equations framing out a healthy ROI (return on investment) will be devised to meet global market demands shortly.

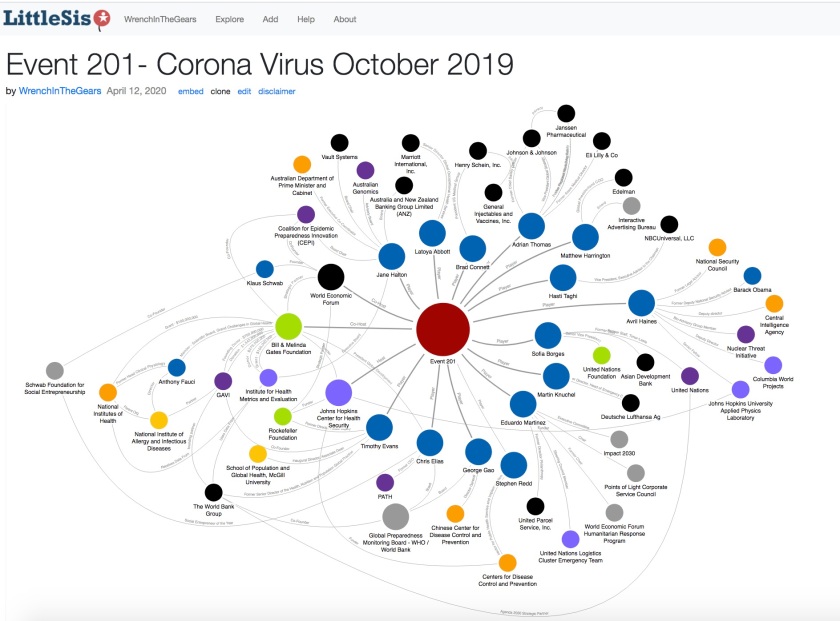

Over the past month, the gaze of investigative researchers has been fixed on GAVI, Bill Gates, Gates’s associates like Fauci, and the over-size influence they are having on public health policy around Covid-19. Use the link for the map to dig further into the relationships. The members of the 2012 Development Impact Bond (DIB) Working Group Report are of particular interest, since DIBs are being considered as a way to finance vaccination campaigns.

Among them:

Toby Eccles, Founder of Social Finance and developer of the social Impact Bond

Owen Barder, Former Economic Aide to Tony Blair, UK AID

Elizabeth Littlefield, JP Morgan, World Bank, OPIC, US Impact Investing Alliance

Vineet Bewtra, Lehman Brothers, Deutsche Bank, Omidyar Network

Bob Annibale, CitiGroup Community Development

Chris Egerton Warburton, Goldman Sachs, Lions Head Partners

Rebecca Endean, UK Research and Innovation

Kippy Joseph, Rockefeller Foundation, International Development Innovation Alliance

Oliver Sabot, Absolute Return On Kids (ARK, UK Charter School), The Global Fund

Steven Pierce, USAID

Public health is a servant of bond markets and financiers. A glance at the participants in this working group makes it clear, doses and people and death and suffering are just going to be part of their market analysis. For too many people, openly discussing concerns about vaccines remains a third-rail. But we DO have to learn how to talk about this to one another, because the stakes are too damn high to shy away from it. I also believe these campaigns and the tracking systems associated with them have been structured as an imperial enterprise and should be treated with profound caution.

Interactive version of Fauci / Gates map viewable here.

The World Bank started promoting the use of Blockchain to track vaccine supplies as early as 2017, the same year they got into the pandemic bond business.

More on that here.

There is an elegant, if twisted, logic in melding vaccine supply chain tracking with blockchain digital identity / health passports. Not unlike Palantir’s “philanthropic” endeavors around human trafficking. The ultimate goal of the cloud bosses is to be able to track everyone all the time – Tolkien’s all-seeing eye. To be able to lay down the infrastructure of digital oppression while being lauded for humanitarian efforts will be quite a coup if they pull it off.

So you have the vaccine tracked on blockchain. You have the quantum dot tattoos (health data bar codes) ready to go. You have the capacity to pressure people into setting up digital health passports linked to their electronic health record (thanks Obama). It makes perfect sense that it would all be linked together.

Fracking Humanity

Total quality management, systems engineering, where the cellular structures of entire communities are unlocked and remade for profit. When I was doing my work into ed-tech, I described the process of data-mining as fracking the minds of children. This is the same thing, but in a medical context-fracking our DNA.

Creating an immutable record of doses linked to specific individuals, means investors can assess the “impact” of inoculation(s) they fund and take their profit. On Blockchain this will be made possible using MIT’s Enigma software, which protects “privacy” even as it mines cellular structure for “impact” and turns people into GMOs. Something I’ve had growing concerns about in recent weeks is knowing the Gates-backed initiatives involve the use of mRNA platforms. Moderna is one of them, and they tout their vaccine system as the “software of life.”

So we know that pay for success relies on MEASURABLE change. We also know these platforms use synthetic biology to re-engineer humans at the molecular level. Precision medicine, while a valuable tool to use against inoperable tumors, could become a huge problem if tweaking our biomes at the population level to suit the whims of global financial markets is normalized. Genetic engineering tied to quarterly returns – now that would be grotesque.

Besides, our country has a nasty history of eugenics and unethical scientific experimentation. What protections are in place to keep “pay for performance” contracts and vaccines from being used to justify “fixing” people that the market deems “sub-standard” from a human capital investment point of view? It is not such a jump from taking an impact payment for preventing a projected future illness to genetic modification for more insidious purposes.

We are being conditioned to accept that there will be repeated campaigns of vaccination tied to future outbreaks. Remember, this is meant to be a “permanent crisis.” Pay for success demands it. It is the crisis framework that legitimizes intrusive surveillance framed as a public benefit. In this way social systems can be regulated to conform to the expectations of global technocrats.

Supply Chain Tracking

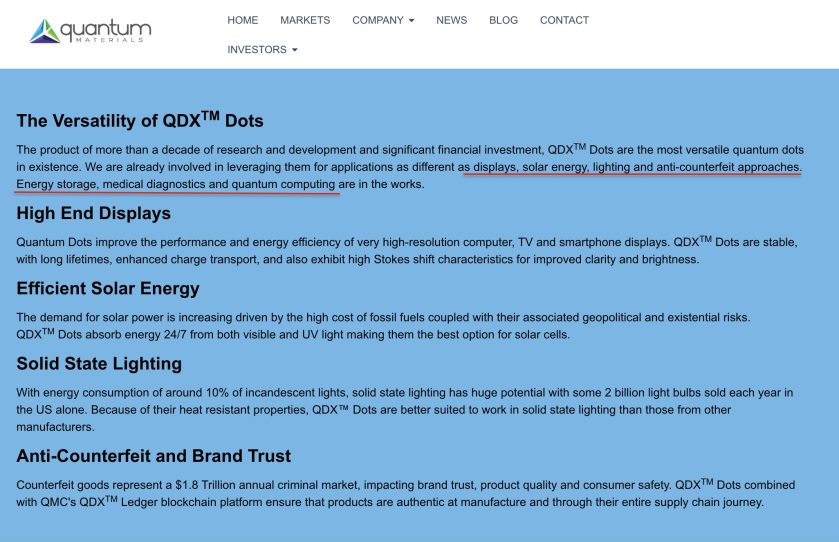

Gates also funded the development of quantum dot vaccine tattoos by MIT, which act as health data bar codes viewable under certain lighting conditions. This nanotechnology is used for such diverse purposes as solar power and device displays. One of the companies developing electronic health records that are compatible with quantum dot data tattoo systems is Quantum Materials out of San Marcos, Texas. Their system runs on Azure, Microsoft’s cloud computing system.

Now imagine Gates-affiliated entities profiting first from vaccine bonds, then from vaccine development, from the cloud computing software tracking the data and documenting the impact, and finally from returns on the pay for success deals.

Meanwhile, the public, those who are actually supposed to be served by health policy, are instead used to generate impact data. This results in healthcare services being platformed, automated, and dehumanized. People will start to lose their humanity, seen only as data, veering into trans-humanist territory after repeated system upgrades.

Interactive version of the QDX Health ID map accessible here.

We can see the mounting toll of the pandemic as hospital systems have started to furlough workers, in the midst of this health emergency. As a consequence, I expect we will soon see human staff reductions, and the roll out of tele-presence medical robots, and more and more doctors on screens where they can operate at a “safe” distance, never needing a mask or to even touch their patient. It is hard to believe this is where we have arrived in the world. And yet, here we undoubtedly are.

Vaccines will be the bread and butter for impact investors; but then factor in the crushing human and economic costs of global pandemic, and suddenly you’re talking REAL money. Imagine tallying up ALL the costs associated with the Covid-19 lockdown. That is going to create one ENORMOUS cost offset for investors moving forward. The longer the lockdown the bigger the cost offset they will be able to use in “pay for success” pandemic deals. For this first round there is a certain sick market logic in making the situation as dire as possible. Future profits are riding on calculations of harm that are being tallied now.

Dress Rehearsal For The Big Event

Many have already looked into Event 201, the corona virus table-top game Gates funded in partnership with the World Economic Forum and the Johns Hopkins Center For Health Security last October. Another funder was Open Philanthropy, started by Facebook Employee #3 Dustin Markovitz. I highly recommend checking out the videos, especially the highlight reel and the communication and finance sessions.

Interactive Map Event 201 here.

I’ve seen comments dismissing concern over this event, because the tabletop game wasn’t actually Covid-19, but rather a generic corona virus. Evidently because authorities had been anticipating a pandemic event, we should just shrug off the fact that a corona virus outbreak occurred mere months after participants checked out of the luxury Pierre Hotel with their souvenir virus plushies. Watch the videos – the event was a spectacle. Certainly not a serious strategic venture. Even the program for the prior year’s game, Clade-X was much more buttoned-up and serious.

A glance over the participant list shows high-level executives from Edelman (public relations) and NBC Universal; George Gao, director of the Chinese Center for Disease Control and Prevention; as well as a number of groups, including Johnson and Johnson and GAVI, that have a stake in vaccine trials underway. While the event was held in New York, there were also participants representing Australia, Canada, Switzerland, China, and the United Nations.

Given Gao’s presence at this event and his participation in the WHO / World Bank’s Global Preparedness Monitoring Board, one wonders at the apparent disintegration of communication channels after the game was over. If Gates, the World Economic Forum, and Johns Hopkins set up Event 201 with the goal of fostering the creation of an integrated global pandemic response strategy, the aftermath of the Wuhan outbreaks and lack of information sharing shows it to have been a spectacular failure. But as I conjectured in my previous post “Mind The Gap” on pandemics and pay for success finance, perhaps the first round was supposed to be a spectacular failure so that it would be easier to show improvement during future outbreaks.

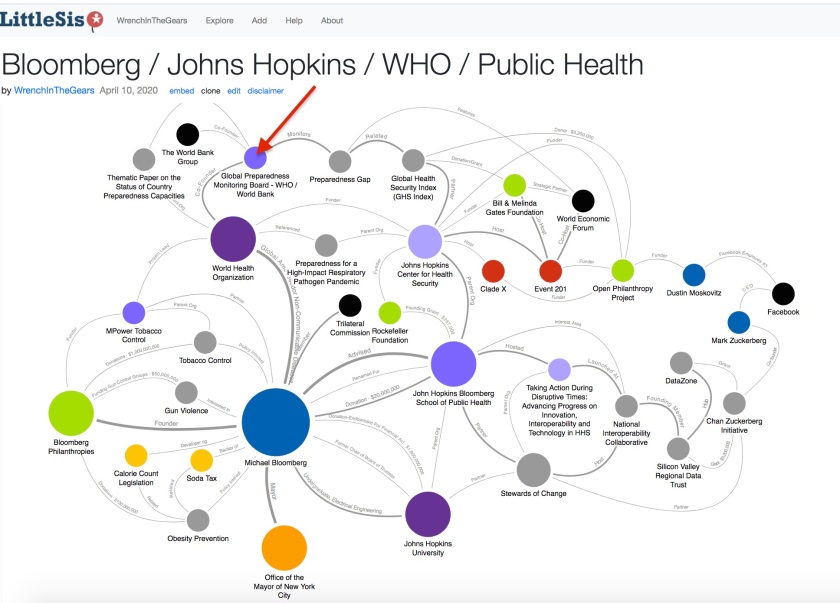

Next up will be a deep dive into Michael Bloomberg and his ties to Johns Hopkins and the World Health Organization. He is the one who is setting up the “smart” city infrastructure steeped in human capital finance and high-tech policing. The Johns Hopkins Center for Health Security, which is based in the Bloomberg School of Public Health was the host of Event 201. See the arrow on the map below.

Interactive version of map here.

[Alison McDowell is a mom and an independent researcher who blogs about the intersection of technology and predatory philanthropy at wrenchinthegears.com.]