Mar 11

20140

350.org / 1Sky, Carbon Markets | REDD, Ceres, Foundations, Non-Profit Industrial Complex, Whiteness & Aversive Racism

350.org CalSTRS Capitalism Ceres Divestment Generation Investment Management Global Reporting Initiative Goldman Sachs. Green Economy Investor Network on Climate Risk neoliberalism New Economics Institute

McKibben’s Divestment Tour – Brought to You by Wall Street [Part III of an Investigative Report] [McKibben: Red, White, Blue & Gold(man Sachs)]

March 11, 2014

Part three of an investigative series by Cory Morningstar

Divestment Investigative Report Series [Further Reading]: Part I • Part II • Part III • Part IV • Part V • Part VI • Part VII • Part VIII • Part IX • Part X • Part XI • Part XII • Part XIII

“Of all our studies, it is history that is best qualified to reward our research.” — Malcolm X

Preface: A Coup d’etat of Nature – Led by the Non-Profit Industrial Complex

It is somewhat ironic that anti-REDD climate activists, faux green organizations (in contrast to legitimate grassroots organizations that do exist, although few and far between) and self-proclaimed environmentalists, who consider themselves progressive will speak out against the commodification of nature’s natural resources while simultaneously promoting the toothless divestment campaign promoted by the useless mainstream groups allegedly on the left. It’s ironic because the divestment campaign will result (succeed) in a colossal injection of money shifting over to the very portfolios heavily invested in, thus dependent upon, the intense commodification and privatization of Earth’s last remaining forests, (via REDD, environmental “markets” and the like). This tour de force will be executed with cunning precision under the guise of environmental stewardship and “internalizing negative externalities through appropriate pricing.” Thus, ironically (if in appearances only), the greatest surge in the ultimate corporate capture of Earth’s final remaining resources is being led, and will be accomplished, by the very environmentalists and environmental groups that claim to oppose such corporate domination and capture.Beyond shelling out billions of tax-exempt dollars (i.e., investments) to those institutions most accommodating in the non-profit industrial complex (otherwise known as foundations), the corporations need not lift a finger to sell this pseudo green agenda to the people in the environmental movement; the feat is being carried out by a tag team comprised of the legitimate and the faux environmentalists. As the public is wholly ignorant and gullible, it almost has no comprehension of the following:

- the magnitude of our ecological crisis

- the root causes of the planetary crisis, or

- the non-profit industrial complex as an instrument of hegemony.

The commodification of the commons will represent the greatest, and most cunning, coup d’état in the history of corporate dominance – an extraordinary fait accompli of unparalleled scale, with unimaginable repercussions for humanity and all life.

Further, it matters little whether or not the money is moved from direct investments in fossil fuel corporations to so-called “socially responsible investments.” The fact of the matter is that all corporations on the planet (and therefore by extension, all investments on the planet) are dependent upon and will continue to require massive amounts of fossil fuels to continue to grow and expand ad infinitum – as required by the industrialized capitalist economic system.

The windmills and solar panels serve as beautiful (marketing) imagery as a panacea for our energy issues, yet they are illusory – the fake veneer for the commodification of the commons, which is the fundamental objective of Wall Street, the very advisers of the divestment campaign.

Thus we find ourselves unwilling to acknowledge the necessity to dismantle the industrialized capitalist economic system, choosing instead to embrace an illusion designed by corporate power.

The purpose of this investigative series is to illustrate (indeed, prove) this premise.

+++

Poisonous Apples and Agent Oranges

In the explicit plan by the fund portfolio managers to consult with universities to continue investing in the market albeit in “divested” portfolios [Document: Do the Investment Math: Building a Carbon-Free Portfolio], Patrick Geddes, Chief Investment Officer of the Aperio Group, compares apples and oranges, presenting two separate arguments, masquerading as one: 1) Is it worth investing in “environmentally sound” funds from a financial standpoint? and 2) Are “environmentally sound” funds environmentally sound?In the document, the first question trumps the second. In fact, the paper, in its entirety, is framed in these terms. The fact that there is no such thing as an “environmentally sound fund” is moot. Rather, it’s all about whether a fund makes profit.

The webinar “Do the Investment Math—Building a Carbon-Free Portfolio” explores in detail the risk impact of divesting from a range of carbon-intensive companies, from the Filthy 15 to the Carbon Tracker 200. The panel, moderated by Andrew Behar, CEO of As You Sow, features Geddes (who explores the risk impact of divesting from carbon), and Dan Apfel, Executive Director of the Responsible Endowments Coalition, who highlights the trend of students calling for divestment and college interest in responsible and sustainable investing.

Activist Robert Jereski wrote to Apfel of the Responsible Endowments Coalition and asked what the “clean tech” that Apfel speaks of actually is, in precise terms. Apfel’s response is as follows: “We interpret clean tech broadly so that investors can find solutions, but also work hard with students so that we can make sure schools avoid things that we consider to be false solutions – fracking, clean coal, as well as trying to figure out what is a good way to do other investment in clean tech. We’re also trying to bridge the gap to more local investments that are not always seen as investable.” The interpretation is so broad that they are apparently unable to actually define it.

In both the webinar and the Q&A period, the word “equity” arises over and over again. Yet in this divestment campaign, brought forward by the oligarchs’ appointed “leader” on climate change, the meaning of equity is that of finance, accounting and ownership. The word equity, as in fairness, does not exist in this patriarchal paradigm: white privilege harnessing climate wealth, as the solution to our global accelerating ecological crisis.

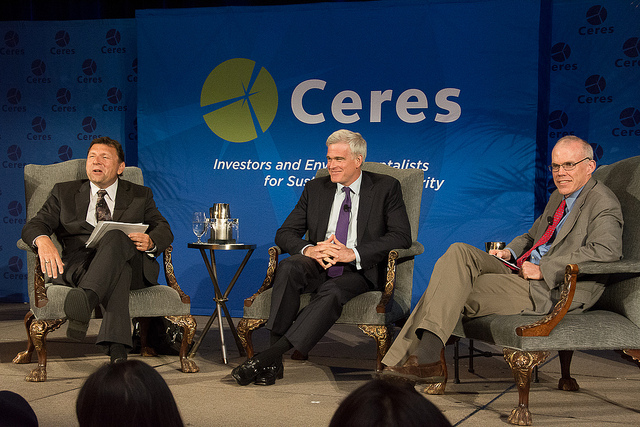

May, 2013: “CalSTRS CEO Jack Ehnes, Generation Investment Management Co-Founder David Blood and 350.org’s Bill McKibben have a lively conversation about how investors can influence the transition to a low-carbon economy.” Ehnes also serves on the Ceres board of directors.

McKibben: Red, White, Blue and Gold(man Sachs)

“What can our ‘socially responsible’ investment managers say when they invest in the stocks of banks, like Citibank and JP Morgan-Chase, and government contractors, like IBM and AT&T, who are running critical parts of government as these manipulations occur – including the disappearance of $4 trillion from government bank accounts and the manipulation of the gold markets and inventory in a silent financial coup d’etat?” — Catherine Austin, March 14, 2006

McKibben opens his 2013 Ceres presentation (McKibben was also a Ceres guest speaker in 2007) with some welcome honesty, speaking of his long-standing friendships/relationships with many Wall Street darlings. Prior to co-founding Generation Investment Management, David Blood served as the co-CEO and CEO of Goldman Sachs Asset Management. Prior to this position, Blood served in various positions at Goldman Sachs Group, Inc., including “Head of European Asset Management, Head of International Operations, Technology and Finance, Treasurer of the Goldman Sachs Group, L.P. and Head of Global Private Capital Markets. Mr. Blood was the first recipient of the John L. Weinberg Award in 1990, an award given to a professional in the investment banking division who best typifies Goldman Sachs’ core values.” [Source]

In the same 2013 Ceres presentation, McKibben furthers his irresponsible and negligent lie, basing it on the illusion of staying below a deadly +2ºC within an economic system dependent upon growth and the further allowance of burning fossil fuels. In reality, we’re committed to far past 2ºC today, not including feedbacks, [+2.4ºC, Ramanathan and Feng 2008 paper] and looking at a +6ºC future void of most all life.

“[But] we should accept the fact that we have actually written off some of the southern hemisphere communities as a consequence of sticking to 2 degrees centigrade.” — Kevin Anderson

“No scientist believes the 2 degree limit is safe, just corporate NGOs.” —Chris Shaw, writer/researcher | Note that the red square highlighting “2 degree Celsius” and the arrow appear in the original image/presentation.

McKibben proceeds to cite his long-time friend/associate, Bob Massie [1], an integral supporter/promoter of the 350.org divestment campaign.

Global Reporting Initiative

In 1994, Bob Massie won the statewide primary election and became the Democratic candidate for Lieutenant Governor of Massachusetts. He served as Executive Director of Ceres from 1996 to 2003, and was on the Ceres Board of Directors from 2001-2009. [Note that in 2003, the organization dropped the CERES acronym and rebranded itself as “Ceres”.] During his tenure as executive director of Ceres, Massie increased the Ceres organization’s size and revenue ten-fold. Massie also “proposed and led the creation of the Investor Network on Climate Risk and the Institutional Investor Summit on Climate Risk, a major gathering of public and private sector financial leaders held every two years at UN Headquarters in New York City. In 1998, in partnership with the United Nations and major U.S. foundations, he co-founded the Global Reporting Initiative with Dr. Allen White of the Tellus Institute, and served as its Chair until 2002.” [Source] [Dr. Allen White is also founder of Global Initiative for Sustainability Ratings (GISR) – a joint project of Ceres and Tellus Institute.]

“‘Working increasingly with the business sector as a partner, we in the UNDP welcome the Global Reporting Initiative as a critical effort to strengthen the practice of monitoring and measuring corporate sustainability.’ —United Nations Development Programme” (in Ceres 2001 Annual Report)

The Global Reporting Initiative website outlines the timeline and key events as follows:

GRI’s inclusive, multi-stakeholder approach was established early, when it was still a department of CERES. In 1998 a multi-stakeholder Steering Committee was established to develop GRI’s guidance. A pivotal mandate of the Steering Committee was to “do more than the environment.” On this advice, the framework’s scope was broadened to include social, economic, and governance issues. GRI’s guidance became a Sustainability Reporting Framework, with Reporting Guidelines at its heart.

The first version of the Guidelines was launched in 2000. The following year, on the advice of the Steering Committee, CERES separated GRI as an independent institution.

The second generation of Guidelines, known as G2, was unveiled in 2002 at the World Summit on Sustainable Development in Johannesburg. GRI was referenced in the World Summit’s Plan of Implementation. The United Nations Environment Program (UNEP) embraced GRI and invited UN member states to host it. The Netherlands was chosen as host country.

In 2002 GRI was formally inaugurated as a UNEP collaborating organization in the presence of then UN Secretary General Kofi Annan, and relocated to Amsterdam as an independent non-profit organization. Ernst Ligteringen was appointed Chief Executive and a member of the Board.

It is of interest to note that the GRI Secretariat is headquartered in Amsterdam, the Netherlands while “Ceres continues to serve as the U.S. advocate for corporate and investor use of the GRI, and Bob Massie from Ceres serves on the GRI board of directors.” [Ceres 2003 Annual Report] The GRI’s Board of Directors [2] met for the first time on April 3, 2002. The directors included, but were not limited to, representatives from Deutsche Bank Group, Royal Dutch/Shell, Bob Massie for Ceres, and American Federation of Labor–Congress of Industrial Organizations.

GRI is financed by its global network; corporate and governmental sponsorships, Organizational Stakeholders, revenue from GRI products and services and its core support and grants from governments, foundations and international organizations including the Swedish International Development Cooperation Agency, the Norwegian Ministry of Foreign Affairs, Germany’s state-owned Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) and the Australian government. Previous institutional supporters include the European Commission, Charles Stewart Mott Foundation, UN Foundation, World Bank, International Finance Cooperation (IFC), John D. and Catherine T. MacArthur Foundation, Ford Foundation, Bill and Melinda Gates Foundation, Rockefeller Brothers Fund, Spencer T. and Ann W. Olin Foundation, United States Environment Protection Agency, V. Kann Rasmussen Foundation, the Soros Foundation, and governmental bodies from the United Kingdom, Sweden, Norway, Germany, and Australia.

“With South Africa liberated, Massie went on to other things. Lots of other things. He became an ordained Episcopal minister; he was the Democratic nominee for lieutenant governor in his native Massachusetts (in a bad year, up against the Gingrich contract-with-America GOP groundswell). And he took up the global warming fight, bringing his expertise to bear as president of Ceres, a national coalition of environmental and investor groups. He went on to found the Global Reporting Initiative, one of the first attempts to hold businesses accountable for their carbon emissions.” — Bill McKibben, Nov 2012

In the above quote, McKibben states “With South Africa liberated, Massie went on to other things.” McKibben either failed to recognize that the transition was from racist apartheid to economic apartheid or, perhaps, simply viewed/views the transition to the hegemonic nature of neoliberalism as a “success.” [Video source: John Pilger, Apartheid Did Not Die. An analysis of South Africa’s new, democratic regime.] It is also imperative to acknowledge that the “attempt” by Massie (as cited by McKibben above) and others within the non-profit industrial complex with their “first attempts to hold businesses accountable for their carbon emissions” has proven to be an epic fail of unparalleled proportions. Despite relentless rhetoric and marketing of such schemes/collaborations/partnerships as success stories, emissions since the launch of the Ceres (1987) and GRI (2000) guidelines have skyrocketed, having increased over 40%; atmospheric CO2 has been pushed to its highest in 15 million years, at an unprecedented rate; ocean acidification has increased 30% with the oceans being acidified faster than at any time in the past 800,000 years and soon, faster than in the past 300 million years. All the marketing and hype will not make this fact any less so. “War is peace. Freedom is slavery. Ignorance is strength.” Failure is success. George Orwell lives on.

In 2002, Massie was named one of the 100 most influential people in the field of finance by CFO Magazine. In 2008, Massie was awarded the Damyanova Prize for Corporate Social Responsibility by the Institute for Global Leadership at Tufts University, and in 2009 he received the Joan Bavaria [founder of Ceres] Innovation and Impact Awards for Building Sustainability in Capital Markets.

In January 2011, Massie declared his candidacy for the United States Senate and began actively campaigning for the Democratic nomination for that office. McKibben actively supported Massie’s campaign utilizing his brand 350.org. [Fundraiser with Bill McKibben, Founder of 350.org: “Mark your calendars: Thursday, June 2nd, Bill McKibben, a founder of the grassroots organization 350.org, is coming to Massachusetts to speak at a fundraiser for Bob’s campaign for US Senate.”]

In March 2012, Massie became the president of the New Economics Institute.

“Ceres and GRI pursue an innovative approach to corporate responsibility which relies on transparency and reputational incentives as opposed to traditional bureaucratic regulation alone. Initially considered impractical, this approach has proven far more effective and efficient at improving social, environmental and human rights performance than traditional regulatory methods alone. More than two thousand major corporations and institutional investor groups now voluntarily participate in Ceres and GRI corporate disclosure standards.” [Emphasis added] [3]

If the voluntary approach as described above has “proven far more effective and efficient at improving social, environmental and human rights performance than traditional regulatory methods alone,” it is hard to imagine what a failure would look like as we edge ever closer towards the final curtain call on what many scientists refer to as Earth’s sixth extinction or the Holocene Extinction .[4] If Coca-Cola and other like-minded corporate psychopaths receive accolades under the Ceres banner of “[H]uman rights performance” (which they do) as they continue to assassinate union leaders in Latin America, what does Ceres consider to be human rights violations? Ceres, although clearly audacious, also understands the psychology of one pining for and readily accepting what one wishes to hear – regardless of whether the facts state otherwise. Like kittens lapping up a bowl of fresh milk, psychopaths have a tendency to lap up such luxurious lies.

Seduction by Omission

In the divestment lecture by McKibben and Massie titled Divestment and the New Economy, it is relatively easy to understand why activists, well-intentioned students and citizens are easily seduced. Language is everything and both McKibben and Massie are extraordinarily experienced, perhaps even gifted, at using palatable and acceptable terminology. Key words that are recognized by many as false solutions (i.e., “green economy”) are omitted, with terms such as “sustainable enterprises” and “fossil-free portfolios” used and exercised in their place. Yet, what is far more stealthy is the language that is purposely omitted: critical discussion as to how colonialism, imperialism, racism and patriarchy are propelled forward and normalized in our commodity culture, via non-fossil fuel investments. Under the economic system of industrialized capitalism, infinite growth of any investment dependent upon Earth’s natural resources is not, and cannot be made to be, sustainable. This is the elephant in the room that no one dares speak of.

Socially Responsible Investing Options: McDonald’s, ConocoPhillips and Nike

“To assess the ‘personality’ of the corporate ‘person,’ a checklist is employed, using diagnostic criteria of the World Health Organization and the standard diagnostic tool of psychiatrists and psychologists. The operational principles of the corporation give it a highly anti-social ‘personality’: it is self-interested, inherently amoral, callous and deceitful; it breaches social and legal standards to get its way; it does not suffer from guilt, yet it can mimic the human qualities of empathy, caring and altruism. Four case studies, drawn from a universe of corporate activity, clearly demonstrate harm to workers, human health, animals and the biosphere. Concluding this point-by-point analysis, a disturbing diagnosis is delivered: the institutional embodiment of laissez-faire capitalism fully meets the diagnostic criteria of a ‘psychopath.'” —The Corporation, The Pathology of Commerce, Case Histories Divest for our Future, 350.org’s divestment website, recommends “environmentally and socially responsible funds.” [5]

Social responsible investing (SRI) is to serve one purpose: the human purpose. SRI serves/benefits only those with the monetary means to invest – meaning those of privilege. In 2009 Forbes provided a list of the top ten “Socially Responsible Buys.” Number 4 was Energen – a diversified energy company involved in natural gas distribution and oil and gas exploration and production. Number 10 was Apache, which develops and produces natural gas, crude oil and natural gas liquids. In 2013 things don’t look much different when we view the top 25 ranked socially responsible dividend stocks. Number 20 is Consolidated Edison (natural gas). On Feb 4, 2013 Forbes reported Northeast Utilities a top socially responsible dividend stock. Note that on Feb 20, 2014, it was reported that “Northeast Utilities (NU) Opposes Solar to Protect Profits” [Source]. Most SRI funds are heavily invested in one type of fossil fuel or another. Examples are Parnassus Equity Income Fund (approx. 14% of assets are held in oil, natural gas and electric utilities), TIAA-CREF Social Choice Equity Fund (owns shares in dozens of oil and gas corporations including Hess, Marathon and Sunoco, and shale gas corporations, Devon Energy (named the “producer of the year” by Oilsands Magazine) and Range Resources), Calvert Equity Portfolio (approx. 10% of its portfolio comprised of fossil fuels with Suncor one of its largest holdings, which says on its website that it was “the first company to develop the oil sands, creating an industry that is now a key contributor to Canada’s prosperity”) and the Domini Social Equity Fund (among its top 10 holdings is Apache Corp). [Source]

Green Money Journal cited the following as one of five “top socially responsible investing news stories of 2004” as reported by SocialFunds.com:

“While shareowners have for years withdrawn resolutions when companies comply with their terms, 2004 saw an increasing number of such instances. Energy companies Cinergy (CIN), American Electric Power (AEP), TXU (TXU), and Southern Company (SO) agreed to prepare reports on the risks posed by climate change and company plans to mitigate such risks, and Reliant (REI) agreed to increase climate risk disclosure.”

In light of this top news story of 2004 applauding Southern Company’s corporate responsibility, one might wonder, eight years later, how this lauded corporation has since evolved.

It has evolved the way one would expect any psychopath to evolve:

“To insulate themselves against charges of environmental racism for poisoning poor blacks in Burke County, Southern Companies doesn’t just make wild claims about how many [new] Homer Simpson jobs … its nuclear plants will produce. Southern Companies purchased its very own civil rights organization, the Atlanta-based Southern Christian Leadership Council, originally founded by Dr. Martin Luther King himself. A Southern Companies CEO headed up SCLC’s building fund and raised over $3 million to pay for its new office buildings on Atlanta’s Auburn Avenue.” June 27, 2012, Black On The Old Plantation

Giving Up Nothing

“Walden Equity (WSEFX) illustrates the variety among SRI funds. Its holdings include McDonald’s, energy giant ConocoPhillips and Nike, which has had its own labor problems…. Walden, which charges 1.0% per year, has beaten the S&P 500 by 2.8 points a year over the past five years…. So, giving up practically nothing, you can get a warm feeling that your money is serving a useful purpose – even if the fund manager or index composer is deciding what that purpose should be. Not a bad deal.” — 5 Mutual Funds for Socially Responsible Investors, May, 2012

“Responsible But Still Profitable – Investors, however, don’t want to suffer losses on their investments, even if they are socially responsible ones. With that in mind, here are five stocks currently listed on the Dow Jones Sustainability United States Index that have produced positive returns over the past year…. limiting your investment selections to companies listed on an index such as this will likely not create an investment portfolio that perfectly matches all of your political and ethical concerns, but it will ensure that your investment capital goes into companies that are regarded as socially responsible on average compared to most companies.” — 4 Socially Responsible Stocks To Watch, Investopedia, June 26, 2012

Image: Investopedia

Most all social fund portfolios claim that the funds will consider a company’s performance with respect to environmental responsibility, labor standards, and human rights. This claim must be acknowledged as nothing but marketing rhetoric given Coca-Cola – one of the top offenders on environment degradation, labor and human rights on the planet – is considered a “socially responsible” investment.

The idea that one can divest from Suncor and Exxon and re-invest it into top ranked socially responsible dividend stock such as Pepsi and McDonald’s, and that this is going to somehow develop a “sustainable” economy that will help tackle climate change, is more than a little hopeful. It’s delusional. Don’t like Pepsi? How about Apple? One need not worry about the modern day slaves in China jumping to their deaths from the sweatshop rooftops, just click over to SumOfUs where you can click a petition “to Apple telling them to make the iPhone 5 ethically.” [SLIDESHOW: 25 Top Ranked Socially Responsible Dividend Stocks, Nov. 22, 2013] All is good for the privileged hyper-consumer in the world of make-believe where “real change” is only a click away.

Make no mistake, one can divest from Exxon and reinvest in Coca-Cola, but infinite growth – a requirement of the industrialized capitalist system – will not and cannot become tamed under a “good” investment or a “bad” one. Nor can the violence and oppression upon the world’s most vulnerable and Earth’s ecosystems, also inherently built into the system.

Under Michael Bluejay’s list of socially responsible stocks, the author writes:

“On the other hand, some say that no large company is completely clean — some are just “less bad” than others. For example, the largest plastics recycler in the world is also the largest producer of virgin plastic. And while producing bicycles is a laudable goal, critics allege that a major bicycle manufacturer uses sweatshop labor to produce its bikes….

“There are still yet other complications: Over the years the small eco/responsible companies I list on this site invariably seem to get bought out by a larger company, or themselves grow bigger and then attract multinational investors, or go out of business. As an example of the second case, natural foods maker Hain Foods merged with tea maker Celestial Seasonings a while back and then continued to swallow up dozens of small natural foods makers around the country, and is now a big enough player that their biggest investor is Wellington Management, whose primary investors include Exxon Mobil, Pfizer, Alcoa, Gillette, Pepsi, McDonald’s, and Wal-Mart! Who would have guessed?”

Does divesting from fossil fuels ensure one does not invest in nuclear? Not necessarily. From the Sustainable & Responsible Mutual Fund Chart, let’s randomly look at just one fund, in this instance, Calvert International Opportunities Fund Y. Under the heading Environment: Climate / Clean Technology we find:

“Restricted/Exclusionary Investment – No investment in companies that own or operate new nuclear power plans, but may invest in companies with existing nuclear power if they are demonstrating leadership in alternative energy.” [Emphasis added.]

Under the heading Social: Human Rights:

“Restricted/Exclusionary Investment: Avoids investing in companies that directly support governments that systematically deny human rights, including those under international and/or US sanction for human rights abuses.” [Emphasis added.]

The irony is grandiose: “Avoids investing in companies that directly support governments that systematically deny human rights.” If this were true, most every U.S. corporation would be “avoided” seeing that the U.S. government has the most appalling history of human rights abuses of all states in the entire world. Never has a single country inflicted so much pain and suffering in almost every corner of the globe.

The Right “Track” for Green Investors

On October 12, 2012 the Guardian featured an article titled How to invest ethically (“As National Ethical Investment Week begins, we look at the latest thinking on green finance and joining the ethical revolution”). Reflecting the fact that water will become exceedingly scarce as planetary tipping points continue to be crossed, perhaps it is of little surprise that the second choice for the opportunistic ethical investor is water. The article states: “Desalination will be a significant investment play for ethical investors, naming GE, Suez and Siemens as potential stock beneficiaries. And most green funds now have a portion of their portfolio dedicated to water stocks, while others, such as Pictet Water, invest only in water.” And what was the number one choice for the ethical investor? Incredibly, it is rail. Rail is highlighted as “[T]he right track for green investors.” The irony is rich – literally. Not only did those behind the creation of the Keystone Pipeline campaign distract the populace long enough for Obama’s financial advisor, Warren Buffett, to build a 21st century North American rail empire, hell, now one can even invest in his rail company BNSF under the guise of ethical investment. Move your money from tar sands investments over to the rail. This way you can watch the oil roll down the tracks, but without holding a direct investment in the oil itself. And the best part is you can feel like you’re saving the world. [From the article: “Shares in railroad companies have soared… In 2009, legendary investor Warren Buffett bought America’s second biggest rail operator, Burlington Northern Santa Fe, in a deal valuing the company at $44bn, while CSX, the third biggest operator, has seen its share price quadruple since 2004.”]

February 13, 2014: A 120-car Norfolk Southern Corp train carrying heavy Canadian crude oil derailed and spilled in western Pennsylvania. On January 6, 2005 a Norfolk Southern train hauling chlorine through Graniteville, South Carolina, derailed. The result was toxic gas that poured into the town. Nine people lost their lives on the day of the accident. On June 10, 2010, a Norfolk Southern train derailed in Liberty, SC spilling toxic substances.

Both Norfolk Southern and CSX rail corporations are listed among the “Top 25 Socially Responsible Dividend Stocks” in a recent ranking by the Dividend Channel (August 21, 2013). Norfolk (“Giving Mother Nature a High Five”) has also been named in the “Top 100 Military Friendly Employers list” by G.I. Jobs magazine while CSX (“See how CSX is driven to protect the environment”) is the largest coal transporter east of the Mississippi River. CSX is also prepared for growth in the oil by rail market: “CSX’s recently announced capacity expansion will support crude oil growth to the Northeast. The $26 million investment in 2013 adds passing sidings along our River Line running south from Albany, NY to provide even more train capacity to serve the crude oil market. Overall, CSX is investing $2.3 billion into our network and strategic assets in 2013. Currently, CSX has the ability to handle more than 400,000 barrels of crude per day into the Philadelphia market alone. Additionally, our network is capable of handling the largest capacity tank cars (286,000 gross weight on rail), maximizing your barrels loaded per car. This gives you the ability to ship more crude per train and lowers the per barrel transportation costs.”

The SRI Mutual Fund Industry: A Free-for-all

“Colonization, imperialism, slavery, and virtually all wars are directly attributable to oligarchies trying to achieve the highest return on investment. It is called ‘sacred hunger’ in Barry Unsworth’s prize-winning novel of the same name on the slave trade. How the SRI industry came to believe that it could use avarice to reverse the suffering that greed causes has everything to do with marketing and nothing to do with philosophy.” — Paul Hawken, 2004

“Clearly no large company has changed its fundamental business practices due to SRI retail investing.” — Paul Hawken, 2004

In 2004 Paul Hawken wrote:

“Imagine an organic food trade association any company could join. Members set the standards to suit themselves. Thus, any store or company can label their products ‘organic’ if they choose because there are no rules defining what organics mean. If your company does anything to improve its production methods, no matter how inconsequential, it qualifies for membership and can use the word ‘organic’ on its labels.

The association gives an annual prize to an academic paper, showing that if you eliminate six of the twelve pesticides commonly used on lettuce, you still get as much lettuce as before. Consumers who want to know about the food they buy can’t find out how it is grown or how it is certified. Instead of an independent outside agency, association members hire private for-profit ‘screening’ companies to determine what’s organic. The screening companies compete, each has a different screening method, and none reveal how they define or determine organic. The screening standards allow 90% of all the food produced in the world to be labeled organic. Inside this organization a small group of core producers believe organic should mean ‘no use of synthetic pesticides and fertilizers.’ The big food companies are amused by this group’s romanticism and see them as ‘idealists.’

Sound ridiculous? Yes, but this trade association exists. It doesn’t sell food, it sells investments. It is the international socially responsible investing (SRI) mutual fund industry. Like the imaginary trade group, it has no stands, no definitions, and no regulations other than financial regulations. Anyone can join; anyone can call a fund an SRI fund. Over 90% of Fortune 500 companies are included in SRI mutual fund portfolios.”

Hawken’s summary:

1. The cumulative investment portfolio of the combined SRI funds is virtually no different than the combined portfolio of conventional mutual funds.

2. The screening methodologies and exceptions employed by most SRI funds allow practically any publicly-held corporation to be considered as an SRI portfolio company.

3. Fund names and literature can be deceptive, not reflecting the actual investment strategy of the managers.

4. SRI in advertising caters to people’s desires to improve the world by avoiding bad actors in the corporate world, but it can be misleading and oftentimes has little correlation to portfolio holdings.

5. There is a lack of transparency and accountability in screening and portfolio selection.

6. The ability for investors to do market-based comparisons of different funds is difficult if not impossible.

7. There is a strong bias towards companies that aggressively pursue globalization of brands, products and regulations.

8. The environmental screens used by the portfolio managers are loose and do little to help the environment.

9. The language used to describe SRI mutual funds, including the term “SRI” itself, is vague and indiscriminate and leads to misperception and distortion of investor goals.

10. Although shareholder activism is cited as a reason to invest in SRI mutual funds, few SRI mutual funds engage in shareholder advocacy or sponsor activist shareholder resolutions.

Perhaps the single most important and overlooked statement within Hawken’s report was as follows:

“The single most important criterion for a company is whether its products or services should exist at all.”

The report is damning – especially in light of the fact Hawken is an avid supporter/promoter of “natural capitalism.” “In keeping with their longstanding commitment to green capitalism, in 1982 Hawkin’s coauthors Hunter and Amory Lovins founded the green think-tank and consultancy Rocky Mountain Institute, which has worked with all manner of large and small companies including Royal Dutch Shell and Walmart, and with governmental clients such as the Pentagon.” [Source]

Following this report, Hawken went on to found the Highwater Global Fund with Michael Baldwin. Highwater, with Portfolio 21, are considered to be two of the most ethical funds that exist. Yet both funds have holdings in Banco Bradesco – an investor in REDD. [“The FAS is an innovative institution, created by the state government of Amazonas and Bradesco Bank, also the maintainer. Among the other organizations that support it are Coca-Cola, Amazon Fund – BNDES, Marriott International, Samsung, and other operational partners.”] [WATCH: Indigenous Peoples Aggressively Targeted by Manipulative NGOs Advancing REDD Agenda]

“[REDD is] a policy that grabs land, clear-cuts forests, destroys biodiversity, abuses Mother Earth, pimps Father Sky and threatens the cultural survival of Indigenous Peoples. This policy privatizes the air we breathe. Commodifies the clouds. Buy and sells the atmosphere. Corrupts the Sacred… It is time to defend Mother Earth and Father Sky. Your future depends on it.” — Tom Goldtooth, Executive Director, Indigenous Environmental Network Oct 22. 2013

Portfolio 21 also has holdings in gas: “Portfolio 21 Investments will invest in companies involved in the transmission and distribution of natural gas as well as in utilities that utilize natural gas as a fuel source.” [Source]

The top ten equity holdings of Highwater are: Apple; Banco Bradesco; Cisco; EnerNOC; Ford Motors; Hyflux; Natura Cosmetics; Novozymes; SSL International; and Vivo Participacoes (Highwater Global Fund, 2010). Although addressing poverty appears to be a predominant area of interest in Hawken’s extensive CV, those with limited funds need not contact Highwater Global Fund anytime soon. The minimum investment bar creates yet another exclusive venue where only the monetarily rich have access to Highwater’s services, furthering class distinction and division.

It’s not that Highwater or Portfolio 21 are “evil,” rather, it is simply the nature of capitalism. The nature of the beast. Profit comes first.

“Some claim that the SRI label has become a little too elastic. In 2010, a report from ethical financial advisers Barchester Green said many UK funds cannot justify the labels applied to them. It was particularly critical of the Zurich Environmental Opportunities pension fund, whose top holdings – Shell, BP and miner Rio Tinto – resembled ‘an environmental investor’s blacklist.’ Conservative investors might approve of the Ave Maria Catholic Value fund’s screening out of supposed sin stocks, but not be keen that controversial oil company Halliburton is one of its biggest holdings.” — Ethical wrapper can contain some surprising names, October 22, 2013

From Exxon to BP

It is somewhat ironic that Ceres was launched in 1989 (presented to the public as The Valdez Principles), exploiting the Exxon Valdez spill to build its own brand recognition and value as the corporate watchdog. Jump forward to the April 20, 2010 BP oil spill, which is considered the largest, most catastrophic, accidental marine oil spill in history – surpassing the cataclysmic Exxon oil spill of 1989. How many people know that up until this disaster, BP was a top holding SRI fund. Also not to be forgotten as a top holding SRI investment before its demise in 2004 was none other than Enron – the poster child for corporate malfeasance.

“Regenerative Capitalism”

The December 27, 2012 article (Greenbiz), Why 350.org’s divestment campaign is on the money, is written by Michael Kramer of Natural Investments, another firm of mention in the 350.org divestment documents (Institutional Pathways to Fossil Free Investing).

Kramer (“Regenerative Capitalism“) makes the argument to move fossil fuel divestments to SRI funds. The article ends with Kramer announcing his firm has created a fossil-fuel-free portfolio for investors who can’t bear to invest in fossil fuels. “The time has come to put our money where our values are, and money managers and mutual funds that claim to be sustainable or socially responsible should look very closely at what these words truly mean and reflect upon whether they should use such terminology if they don’t measure up to such a standard.”

Upon further research it was found that the Natural Investments Fossil Fuel Free Portfolio is comprised of ten fixed income and equity funds and that the fund also supports a non-profit organization) (10%). When asked what actual investments comprised the fund, here was the response:

“Thanks for your inquiry. We have identified 10 such funds that meet our financial and broader environmental, social and governance criteria, but it’s certainly possible that there are other fossil fuel free funds that don’t apply such ESG criteria. But given our universe of about 200 sustainable and responsible funds, we’ve indeed found very few that qualify for inclusion. We certainly provide the names of all investments we use to our clients, but not otherwise (though all the responsible funds we consider are listed in the Heart Rating section of our website). As far as the nonprofits we donate to, 350.org is the recipient of a portion of the management fee for the fossil fuel free portfolio, and many other recipients for the rest of our 1%- of- revenues donations are listed here: http://naturalinvesting.com/charitable-contributions. Feel free to be in touch if we can be of further service. Thanks, Michael Kramer, Accredited Investment Fiduciary, Managing Partner, Natural Investments LLC

The transferring of investment funds from fossil fuel investments to SRI investments is not a solution to our unparalleled ecological crisis, with the planet already having crossed a multitude of planetary boundaries. Rather, it is a two-fold distraction with epic consequences. First, it distracts from the very root causes of our ecological/planetary crisis. Second, under this veil, the illusory “green economy,” – the commodification of the planet – is going forward, full throttle, with almost no opposition. This brilliant and diabolical marketing feat employing behaviour change strategies is being carried out by the organizations, firms and NGOs working with and promoting the divestment campaign, while on the surface, 350.org’s “hands” remain clean. SRI fund promoters are not activists. One must never lose sight of the simple fact that their primary duty as a fiduciary is maximum shareholder return.

The SRI industry is not interested in reversing the anguish resulting from colonialism, imperialism, racism, patriarchy, oppression and decimation of environment, as all of this ugliness is inherently built into the system (which then externalizes these costs). The task at hand is the continuance of individualism and greed, normalized into a commodity culture, where all those with monetary means can acquiesce in our collective path to self-destruction. Such a vogue fabrication of, in essence, a kinder, gentler, more compassionate capitalism, is achievable and even preferred in a corporatized society where lies are preferred over truth. Exquisite fabrication, wrapped in opaque vellum, bestowed with a shimmering green bow. It’s not high-gloss marketing over philosophy. High-gloss marketing is the philosophy.

The Mythology of Corporate Social Responsibility (CSR)

Such crafted veneer as the Ceres Principles can be categorized under the similar heading/guise of “Corporate Social Responsibility” (CSR). In the article Corporate Social Responsibility as a Political Resource (February 22, 2010), author Michael Barker writes:

“In June 2003 Gretchen Crosby Sims completed a vitally important Ph.D. at Stanford University titled Rethinking the Political Power of American Business: The Role of Corporate Social Responsibility. Hardly counting herself as a political radical – Sims’s doctorate thesis was supervised by Morris Fiorina, who is presently a senior fellow at the conservative Hoover Institution – the findings of her unpublicized study provide a critical resource for progressive activists seeking to challenge the mythology of Corporate Social Responsibility (CSR). As the British non-profit organization Corporate Watch states, CSR ‘is not a step towards a more fundamental reform of the corporate structure but a distraction from it.’ Indeed, Corporate Watch advise that: ‘Exposing and rejecting CSR is a step towards addressing corporate power….’

As [Weinstein] demonstrated long ago, corporate elites adopted the principles of ‘cooperation and social responsibility’ to sustain capitalism’s inequalities, not to remedy them. To campaign for Corporate Social Responsibility in this present day is akin to demanding the institutionalization of elite social engineering. Capitalist corporations will never be socially responsible, this fact is plain to see; thus the sooner progressive activists identify their enemy as capitalism, not corporate greed or a lack of good-will, then the sooner they will be able to create an equitable world whose political and economic system is premised on social responsibility, not to corporate elites, but instead to all people.” [Emphasis added]

Next: Part IV

[Cory Morningstar is an independent investigative journalist, writer and environmental activist, focusing on global ecological collapse and political analysis of the non-profit industrial complex. She resides in Canada. Her recent writings can be found on Wrong Kind of Green, The Art of Annihilation, Counterpunch, Political Context, Canadians for Action on Climate Change and Countercurrents. Her writing has also been published by Bolivia Rising and Cambio, the official newspaper of the Plurinational State of Bolivia. You can follow her on twitter @elleprovocateur]

EndNotes:

[1] Bob Massie is the President and CEO of the New Economics Institute. An ordained Episcopal minister, he received his B.A. from Princeton Unversity, M.A. from Yale Divinity School, and doctorate from Harvard Business School. From 1989 to 1996 he taught at Harvard Divinity School, where he served as the director of the Project on Business, Values, and the Economy. His 1998 book, Loosing the Bonds: The United States and South Africa in the Apartheid Years, won the Lionel Gelber prize for the best book on international relations in the world. He was the Democratic nominee for lieutenant governor of Massachusetts in 1994 and a candidate for the United States Senate in 2011. During his career he has created or led three ground-breaking sustainability organizations, serving as the president of Ceres (the largest coalition of investors and environmental groups in the United States), the co-founder and first chair of the Global Reporting Initiative, and the initiator of the Investor Network on Climate Risk, which currently has over 100 members with combined assets of over $10 trillion. [Source: New Economics Institute] [2] ROGER ADAMS (United Kingdom) Executive Director-Technical, Association of Chartered Certified Accountants, JACQUELINE ALOISI DE LARDEREL (France) Assistant Executive Director, United Nations Environment Programme, Division of Technology, Industry, and Economics, FABIO FELDMANN (Brazil) former Secretary of Environment, São Paulo, TOSHIHIKO GOTO (Japan) Chair, Environmental Auditing Research Group, JUDY HENDERSON, CHAIR (Australia) immediate-past Chair, Australian Ethical Investment Ltd, former Commissioner, World Commission on Dams HANNS MICHAEL HÖLZ (Germany) Global Head of Sustainable Development and Public Relations, Deutsche Bank Group, JAMSHED J. IRANI (India) Director, Tata Sons Limited, ROBERT KINLOCH MASSIE (United States) Executive Director, CERES, MARK MOODY-STUART (United Kingdom) retired Chair, Royal Dutch/Shell, ANITA NORMARK (Sweden) General Secretary, International Federation of Building and Wood Workers, NYAMEKO BARNEY PITYANA (South Africa) Vice-Chancellor, University of South Africa, former Chair, South African Human Rights Commission BARBARA SHAILOR (United States) Director of International Affairs, American Federation of Labor–Congress of Industrial Organizations, BJORN STIGSON (Sweden) President, World Business Council for Sustainable Development PETER H.Y. WONG (China) Senior Partner, Deloitte Touche Tohmatsu, Hong Kong; and Board Member, International Federation of Accountants. [3] Source: Wikipedia [4] “However these debates will unfold, the Anthropocene represents a new phase in the history of both humankind and of the Earth, when natural forces and human forces became intertwined, so that the fate of one determines the fate of the other. Geologically, this is a remarkable episode in the history of this planet.” [“Geologists from the University of Leicester are among four scientists – including a Nobel prize-winner – who suggest that Earth has entered a new age of geological time.”] Source: Science Daily, March 26, 2010 [5] Are SRI funds as clean and green as you think? by Marc Gunther, December 4, 2012